When you consider the cost to make a grocery store, you encounter a wide range. The cost to make a small shop starts near $10,000, while large supermarkets can require over $2 million. Recent industry data shows the cost to make a medium-sized store usually falls between $70,000 and $150,000. Regional differences also impact the cost to make a grocery store, especially rent.

| Cost Component | Cost Per SF | Total Cost |

|---|---|---|

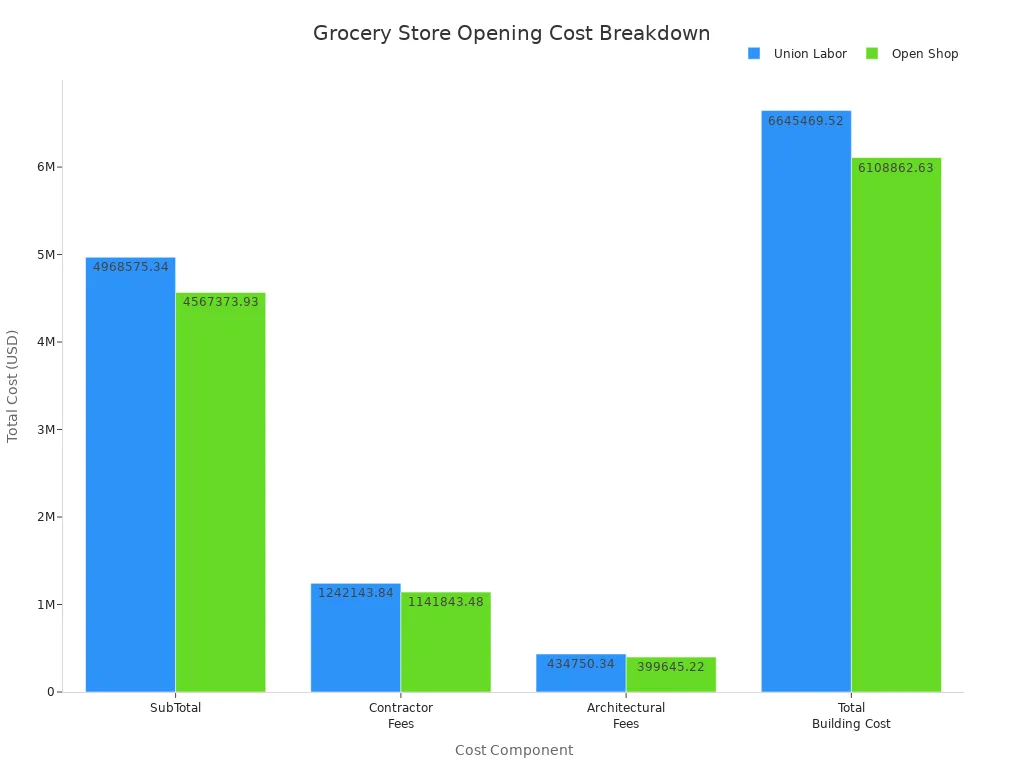

| SubTotal (Standard Union Labor) | $112.92 | $4,968,575.34 |

| Contractor Fees (25%) | $28.23 | $1,242,143.84 |

| Architectural Fees (7%) | $9.88 | $434,750.34 |

| Total Building Cost (Union) | $151.03 | $6,645,469.52 |

| SubTotal (Open Shop) | $103.80 | $4,567,373.93 |

| Contractor Fees (25%) | $25.95 | $1,141,843.48 |

| Architectural Fees (7%) | $9.08 | $399,645.22 |

| Total Building Cost (Open Shop) | $138.84 | $6,108,862.63 |

You can lower the cost to make your store by using new technology such as Electronic Shelf Labels, ESL Gateway AP, and ESL Price Tag systems. These Esl Retail solutions help you manage prices efficiently and reduce labor expenses.

Typical Cost to Make and Open a Grocery Store

National Average Cost to Open a Grocery Store

When you start planning your grocery store opening, you need to understand the national average cost to open a grocery store. The cost to open a grocery store depends on many factors, including location, size, and type of store. You can expect the cost of opening a grocery store to range from $10,000 for a very small shop to over $6 million for a large supermarket. Most new owners find that grocery store opening costs for a small corner store fall between $35,000 and $50,000. If you choose a franchise model, you will likely pay a one-time fee between $55,000 and $85,000. You must also budget for supplies, inventory, permits, licenses, and bonds.

Tip: You should create a detailed business plan before you commit to your initial investment. This plan will help you estimate your grocery store startup costs and avoid surprises.

Grocery Store Opening Costs by Store Size

The size of your store will have a major impact on your grocery store opening costs. You need to match your store size to your target market and your available capital. The table below shows typical startup costs for different store sizes:

| Store Size | Cost Range |

|---|---|

| Small grocery store | $10,000 – $50,000 |

| Medium-sized grocery store | $50,000 – $200,000 |

| Large supermarket | $200,000 and above |

Small Neighborhood Grocery Store

If you plan on starting a grocery store in a small neighborhood, you can keep your initial investment low. You will likely spend between $10,000 and $50,000 on your grocery store opening. This budget covers basic renovations, shelving, refrigeration, and a modest inventory. You may need to pay for a few months’ rent upfront. You should also include technology, such as a point-of-sale system, in your grocery store business plan.

Medium-Sized Grocery Store

A medium-sized grocery store requires a larger initial investment. You will need to budget between $50,000 and $200,000 for your grocery store opening costs. This range covers more extensive renovations, a larger inventory, and more advanced technology. You may also need to hire more staff. The following table breaks down typical startup costs for a medium-sized store:

| Cost Category | Estimated Amount |

|---|---|

| Location (3 months rent) | $165,000 |

| Initial inventory | $50,000 to $300,000 |

| Renovations | $30,000 to $50,000 |

| Store setup | $10,000 to $35,000 |

| Checkout and back office technology | $500 to $2,000 |

| Scanners and scales | $500 to $5,000 |

| Business licenses and permits | $300 to $5,000 |

| Marketing costs | $0 to $10,000 |

| Total | $256,000 to $572,000 |

You should include all these categories in your grocery store business plan to ensure you cover every aspect of your grocery store startup costs.

Large Full-Service Grocery Store

If you want to open a large supermarket, you will face much higher grocery store opening costs. The total building cost for a large grocery store can reach $6,645,469.52. You will need a significant initial investment to cover construction, equipment, inventory, and staffing. Your grocery store business plan should address every detail, from site selection to technology upgrades.

Grocery Store Opening Budget by Store Type

The type of store you choose will also affect your grocery store opening costs and your initial investment. You should compare the options below before you finalize your plan.

Independent Grocery Store

When you open an independent grocery store, you usually need a lower initial investment compared to a franchise. You must handle branding, supplier sourcing, and marketing on your own. Careful planning is essential. Your grocery store startup costs will include rent, inventory, equipment, and permits. You should create a detailed business plan to guide your decisions.

Franchise Grocery Store

A franchise grocery store requires a higher initial investment. You will pay franchise fees, licensing, and infrastructure costs upfront. The cost to open a grocery store as a franchise often includes a one-time fee between $55,000 and $85,000. You benefit from established branding and supplier relationships, but you must follow the franchise’s rules and standards.

| Type of Store | Startup Costs Description |

|---|---|

| Grocery Franchise | Involves significant upfront costs including franchise fees, licensing, and infrastructure. |

| Independent Store | Generally requires a lower initial investment but needs extensive planning for branding and supplier sourcing. |

Specialty Grocery Store

If you plan on starting a grocery store that focuses on specialty items, such as organic foods or international products, your grocery store opening costs may vary widely. Specialty stores often require unique equipment, custom shelving, and targeted marketing. You should include these factors in your grocery store business plan and adjust your initial investment accordingly.

Note: Specialty grocery store startup costs can be unpredictable. You should research your niche and consult with industry experts before you finalize your plan.

Major Grocery Store Opening Costs

Location and Real Estate Expenses

Buying vs. Leasing a Store

You must decide whether to buy or lease your grocery store space. Leasing often requires less upfront capital and provides flexibility if you want to test a market. Buying a property gives you long-term control but demands a larger initial investment. Many owners choose leasing because it lowers the barrier to entry and allows you to allocate more funds to inventory and equipment. Commercial lease rates vary widely. The average commercial rent in the U.S. is about $29 per square foot per year. In Detroit, you may pay $18 per square foot, while in southern California, rates can exceed $55 per square foot. Location and rent will shape your monthly expenses and influence your overall budget.

Site Selection and Preparation

You need to select a location that matches your target market and budget. Site preparation costs include design, outfitting, and renovations. Utilities, especially for refrigeration, can add significant expenses—electricity alone averages $1.47 per square foot. Consider these factors when you plan your grocery store:

- Location significantly influences rent and utility costs.

- Site preparation includes expenses for store design, outfitting, and renovations.

- Utility costs, especially for refrigeration, can be substantial.

Renovation and Build-Out Costs

Construction and Remodeling

Renovation and build-out costs depend on your store size and whether you choose new construction or remodel an existing space. New construction usually costs more due to land acquisition and zoning compliance. Remodeling an existing grocery store can be more cost-effective and faster. Many lenders prefer new construction projects and may offer loans with a construction contingency, which adds about 10% to the total project cost. Remodeling also supports sustainability by reducing waste and emissions.

| Business Size (sq ft) | Average Starting Cost |

|---|---|

| 1,000 | $100,000 – $200,000+ |

| 2,000 | $200,000 – $400,000+ |

| 3,000 | $300,000 – $600,000+ |

| 5,000+ | $500,000 – $1,000,000+ |

Fixtures and Interior Design

You must invest in shelving, lighting, signage, and checkout counters. These elements create a welcoming environment and support efficient operations. Fixtures and interior design costs can range from $10,000 to $80,000, depending on your store’s size and concept.

Equipment and Technology Costs

Refrigeration and Freezers

Refrigeration represents a major equipment expense for any grocery store. Total refrigeration costs range from $18,000 to $25,000. Individual units cost between $2,000 and $10,000 each. Display refrigerators can add $3,000 to $6,000 per unit. Installation typically adds 10% to 20% to the equipment price.

Point-of-Sale Systems

A reliable point-of-sale system is essential for smooth transactions. You can expect to pay $2,000 to $6,000 per lane for POS systems. Hardware components and installation costs will vary based on your store’s needs.

Security and Surveillance

Security systems protect your inventory and staff. Basic setups cost between $2,000 and $10,000. You may also need to budget for lighting, signage, and inventory management software.

| Equipment/Technology | Average Cost Range |

|---|---|

| POS System | $1,000 to $5,000 per terminal |

| Inventory Management Software | $100 to $500 per month |

| Self-Checkout Systems | $10,000 to $30,000 per station |

| Security Systems | $2,000 to $10,000 |

| Refrigeration, Shelving, Fixtures | $10,000 to $80,000 |

| Lighting and Signage | $5,000 to $15,000 |

| Deli and Cheese Counter Equipment | $5,000 to $20,000 |

Tip: Plan your equipment purchases carefully to avoid overspending and ensure your grocery store operates efficiently.

Initial Inventory Expenses

Stocking Shelves

When you open a grocery store, purchasing inventory for your shelves becomes one of your largest pre-opening expenses. You need to plan for initial inventory costs that can be much higher than you expect. In fact, the initial inventory expense for a grocery store can consume up to 580% of your projected first-year revenue. This means you must invest heavily in purchasing inventory before you even make your first sale. You will need to stock a wide range of products to meet customer expectations, from fresh produce to packaged goods.

- You should prioritize essential items that drive traffic.

- You must balance variety with budget constraints.

- You need to monitor inventory levels closely to avoid overstocking or shortages.

Tip: Careful planning of your initial inventory helps you avoid tying up too much capital and reduces the risk of waste.

Perishable vs. Non-Perishable Goods

You face different challenges when purchasing inventory for perishable and non-perishable goods. Perishable items, such as dairy, meat, and produce, require careful management due to their short shelf life. Non-perishable goods, like canned foods and dry goods, offer more flexibility in storage and purchasing.

| Aspect | Perishable Goods | Non-Perishable Goods |

|---|---|---|

| Shelf Life | Short, leading to potential waste | Long, allowing for extended inventory |

| Inventory Management | Requires careful tracking to minimize waste | More flexible management practices |

| Cost Implications | High due to waste and markdowns | Lower, as items can be stored longer |

Shipping perishables also increases your cost. You must pay for refrigeration, expedited shipping, and specialized containers. You need additional monitoring systems to maintain freshness. Managing these logistics adds complexity to your purchasing inventory process.

- Perishable goods require more complex logistics.

- You need extra resources to keep items fresh.

- Specialized handling increases overall shipping costs.

Staffing and Training Costs

Hiring Employees

Staffing your grocery store is another major expense. The average hourly wage for grocery store workers in the U.S. is about $25, with a range from $17.79 to $28.85. Labor costs usually account for 9.4% of total sales, and benefits add another 3.4%. This means you should expect labor and benefits to make up 12-13% of your sales. Payroll often becomes your second largest expense after inventory. A monthly payroll of $35,000 can nearly double your rent expense. Healthy revenue is essential for paying staff and hiring more employees.

- Optimizing staffing based on peak hours helps you manage payroll costs.

- Payroll expenses directly affect your ability to invest in inventory and cover other business expenses.

- High average transaction value is crucial to cover payroll and fixed costs.

Training Programs

You must also budget for training programs. Well-trained employees improve customer service and reduce costly mistakes. Investing in training ensures your team understands store policies, safety procedures, and inventory management systems.

Licensing, Permits, and Insurance

Health and Safety Permits

Before you open your grocery store, you need to secure business licenses and permits. Each state has different licensing requirements, so you must check local regulations. Health and safety permits ensure your store meets food safety standards and protects your customers.

Business Insurance

Business insurance protects your grocery store’s financial well-being. You need coverage for property damage, liability, and employee injuries. Proper licensing and insurance help you avoid costly legal issues and keep your store running smoothly.

Note: Always verify licensing requirements and insurance options before launching your grocery store.

Marketing and Grand Opening Budget

You need to plan your marketing and grand opening budget carefully when launching a grocery store. This budget plays a critical role in attracting your first customers and building your reputation in the community. Most new grocery stores allocate between $25,000 and $60,000 for marketing and grand opening activities. This amount covers pre-opening promotions, the grand opening event, and the first three months of advertising. A successful grand opening celebration can cost between $7,000 and $20,000, depending on your goals and the size of your store.

Local Advertising

Local advertising helps you reach your target audience and drive foot traffic to your new store. You should consider a mix of traditional and digital channels to maximize your impact. Many owners use flyers, local newspaper ads, radio spots, and social media campaigns to announce their opening. These efforts help you build awareness and generate excitement before your doors open.

- Local advertising costs are essential for attracting customers and establishing your presence.

- These expenses are variable and can be adjusted based on your sales performance.

- Marketing often starts at 20% of your projected revenue, which helps cover fixed costs like rent and payroll.

You can use the following table to estimate your local advertising expenses:

| Advertising Channel | Estimated Cost Range |

|---|---|

| Flyers & Print Ads | $1,000 – $5,000 |

| Radio Spots | $2,000 – $7,000 |

| Social Media | $1,000 – $4,000 |

| Local Sponsorships | $500 – $2,000 |

Tip: Track your advertising results closely. Adjust your strategy to focus on the channels that deliver the best return.

Promotions and Events

Promotions and events create excitement and encourage shoppers to visit your grocery store during the opening period. You can offer special discounts, free samples, and loyalty programs to attract new customers. Hosting a grand opening event helps you connect with the community and build lasting relationships.

- Grand opening celebrations often cost between $7,000 and $20,000.

- These events can include ribbon-cutting ceremonies, live entertainment, and giveaways.

- Promotions and events help you establish community ties and boost your initial sales.

You should include these costs in your grocery store opening budget to ensure you have enough resources for a strong launch. Effective marketing and memorable events set the stage for long-term success.

Key Factors Influencing the Cost of Opening a Grocery Store

When you plan your grocery business, you need to understand the key factors influencing store costs. These factors shape your budget and impact your long-term success. By focusing on the right elements, you can make smarter decisions and avoid costly mistakes.

Location and Demographics

Choosing your location stands out as one of the most important key factors influencing store costs. The area you select will determine your rent, utility expenses, and customer base. You should study local demographics before making a decision. High-income neighborhoods often attract specialty grocers, while densely populated areas support higher sales volumes. Well-educated communities may demand organic or premium products. Larger households can boost your store’s performance, and competitive lifestyles may draw specialty chains to the area.

| Demographic Factor | Influence on Grocery Store Location |

|---|---|

| Household Income | Higher incomes attract specialty grocers to urban areas |

| Population Density | Specialty grocers prefer densely populated areas |

| Education Level | Well-educated populations are more appealing to grocers |

| Household Size | Larger households can influence store performance |

| Consumer Lifestyle | Competitive areas attract specialty grocery chains |

You should always consider these demographic factors when choosing your location. They directly affect your ability to attract customers and set prices.

Store Format and Size

Store format and size represent key factors influencing store costs. Smaller formats reduce infrastructure and operational expenses. You can open a small-format store more quickly and at a lower cost, especially in cities with high real estate prices. The trend toward smaller stores helps operators minimize costs and recover from operational losses. Focusing on core products also leads to savings.

| Evidence Description | Impact on Opening Costs |

|---|---|

| Smaller store formats reduce infrastructure and operational expenses. | Lower total opening costs due to minimized expenses. |

| Smaller stores can be quicker and cheaper to open, especially in urban areas. | Reduced costs associated with high real estate prices. |

- The shift toward smaller store formats is driven by the need to minimize costs and recoup operational losses.

- Small-format stores focus on core products, which can lead to savings for operators.

You should match your store format to your target market and budget. This approach helps you control expenses and improve profitability.

Ownership Model

Your ownership model is another key factor influencing store costs. You can choose to operate independently or join a franchise. Independent owners have more control over branding and supplier choices, but they must handle all planning and sourcing. Franchise owners pay higher upfront fees but benefit from established systems and support. Your decision will affect your initial investment, ongoing fees, and operational flexibility. You should weigh the pros and cons of each model before committing to your grocery venture.

Supply Chain and Vendor Relationships

You must pay close attention to your supply chain and vendor relationships when planning your grocery store. Strong supplier connections give you the power to negotiate better prices and terms. This advantage directly lowers your opening costs. You can secure favorable payment schedules and bulk discounts by building trust with your vendors. These savings help you allocate more funds to other critical areas, such as inventory or marketing.

Optimizing your supply chain also reduces transportation and inventory management expenses. Efficient logistics ensure that products arrive on time and in good condition. You avoid costly delays and minimize waste. In a low-margin industry like grocery retail, every dollar saved on logistics improves your bottom line.

You should learn from successful operators like Vince’s Market. They maintain relationships with multiple suppliers. This strategy allows them to adapt quickly when shortages occur. If one vendor cannot deliver, they have alternatives ready. You can use this approach to keep your shelves stocked and avoid disruptions. Reliable product availability builds customer trust and supports steady sales from day one.

You should not overlook the importance of vendor diversity. Relying on a single supplier increases your risk. Multiple partnerships give you flexibility and bargaining power. You can compare offers and choose the best terms for your business. This practice keeps your costs under control and strengthens your position in the market.

Tip: Start building your supplier network early. Attend industry events, join trade associations, and seek recommendations from other store owners. Strong relationships with vendors will serve you well as your business grows.

Local Regulations and Compliance

You must understand how local regulations and compliance requirements affect your grocery store’s opening costs. These rules shape your budget and timeline. Consider the following key points:

- Local regulations require you to follow building codes and health standards. These rules often lead to extra expenses for construction, equipment, and staff training.

- The permitting process can become complex and time-consuming. Delays in approvals may increase your costs and push back your opening date.

- Zoning laws determine where you can operate your store. Some areas have strict regulations that limit your options or require costly modifications.

You should research all local requirements before you sign a lease or start renovations. Consult with local authorities and industry experts to avoid surprises. Careful planning ensures that you meet all standards and open your store on schedule.

Note: Staying compliant protects your investment and reputation. Non-compliance can result in fines, forced closures, or legal action. Make regulatory research a top priority in your business plan.

Cost-Saving Tips for Your Grocery Store Opening Budget

Opening a grocery store requires careful budgeting and smart financial decisions. You can take several practical steps to keep your initial investment manageable and set your business up for long-term success. Here are some proven strategies to help you control expenses from day one.

Negotiating Lease Terms

Your lease agreement will likely be one of your largest ongoing expenses. By negotiating favorable lease terms, you can significantly lower your occupancy costs and free up capital for other priorities. When you approach landlords with a well-prepared plan, you increase your chances of securing better rates and flexible terms.

| Benefit of Negotiating Lease Terms | Description |

|---|---|

| Reduced Occupancy Costs | Lower lease payments decrease one of the largest expenses for grocery stores, allowing for better capital allocation. |

| Improved Lease Terms | A well-prepared negotiation can lead to more favorable terms, further reducing costs. |

You should also consider leasing instead of buying your space. Leasing reduces upfront costs, offers potential tax benefits, and allows you to upgrade locations or equipment more easily as your business grows.

Tip: Always review your lease agreement carefully and seek professional advice before signing. Negotiating even small concessions can have a big impact on your bottom line.

Buying Used Equipment

Purchasing used equipment is a smart way to reduce grocery store startup costs. New equipment often comes with a high price tag, but you can find quality used items that perform just as well. This approach lets you allocate more funds to inventory, marketing, or staff training.

- Buying used equipment significantly lowers upfront costs compared to new equipment.

- You gain greater financial flexibility and can invest in other critical areas of your store.

You can also lease equipment, which further reduces your initial investment and may provide tax advantages. Leasing allows you to upgrade to newer models without a large capital outlay, keeping your operations efficient and up to date.

Starting Small and Scaling Up

Launching your grocery store with a smaller footprint helps you manage risk and control expenses. You can focus on core products and essential services, then expand as your customer base grows. This strategy allows you to test your concept, learn what works, and make adjustments before committing to a larger space or broader inventory.

- Start with a limited selection of high-demand products.

- Use customer feedback to guide future expansion.

- Scale up your operations as revenue increases and market demand becomes clear.

You can also implement additional cost-saving strategies as your business grows. The table below highlights several effective methods:

| Strategy | Description |

|---|---|

| Use Inventory Software | Optimize stock levels to avoid overstocking and stockouts. |

| Reduce Manual Labor | Automate processes to save on labor costs and improve efficiency. |

| Optimize Staffing | Schedule staff based on peak hours to reduce unnecessary labor costs. |

| Maintain Refrigeration | Regular maintenance lowers energy costs and prevents expensive repairs. |

| Use FIFO Method | Sell older stock first to minimize spoilage of perishable items. |

| Rightsize Displays | Adjust display sizes to reduce spoilage and improve customer experience. |

| Use Cloud-Based System | Streamline operations and reduce technology costs with modern systems. |

By combining these approaches, you can build a strong foundation for your grocery store and position your business for sustainable growth.

Leveraging Technology for Efficiency

You can use technology to streamline your grocery store operations and reduce costs. Modern tools help you automate routine tasks, improve accuracy, and save time. You should consider these key technologies for your store:

- Inventory Management Software: Track stock levels in real time. This software helps you avoid overstocking and shortages. You can set automatic reorder points and receive alerts when items run low.

- Point-of-Sale (POS) Systems: Speed up checkout and reduce errors. Advanced POS systems integrate with inventory software and provide sales reports. You can analyze which products sell best and adjust your orders.

- Electronic Shelf Labels (ESL): Update prices instantly across your store. ESL systems reduce labor costs and pricing errors. You can run promotions quickly and keep prices accurate.

- Self-Checkout Kiosks: Offer customers a faster way to pay. Self-checkout reduces wait times and allows you to reassign staff to other tasks.

- Cloud-Based Solutions: Access your store data from anywhere. Cloud systems support remote management and data backup. You can monitor sales and inventory even when you are offsite.

Tip: Start with one or two technologies that fit your budget. Expand as your store grows and your needs change.

The table below summarizes the benefits of each technology:

| Technology | Main Benefit |

|---|---|

| Inventory Software | Reduces waste and shortages |

| POS System | Speeds up checkout |

| Electronic Shelf Labels | Cuts labor costs |

| Self-Checkout Kiosks | Improves customer service |

| Cloud-Based Solutions | Enables remote management |

You should train your staff on new systems. Well-trained employees use technology more effectively and help you get the most value from your investment.

Building Strong Supplier Relationships

You need reliable suppliers to keep your shelves stocked and your costs under control. Building strong relationships with vendors gives you access to better prices, flexible payment terms, and priority service during shortages.

Follow these steps to strengthen your supplier partnerships:

- Communicate Clearly: Share your needs and expectations. Good communication prevents misunderstandings and delays.

- Negotiate Terms: Ask for bulk discounts or extended payment periods. Suppliers often reward loyal customers with better deals.

- Diversify Your Vendors: Work with multiple suppliers. This approach protects you from disruptions if one vendor cannot deliver.

- Pay On Time: Build trust by meeting your payment deadlines. Reliable payments encourage suppliers to prioritize your orders.

- Stay Informed: Keep up with market trends and seasonal changes. You can adjust your orders and avoid price spikes.

Note: Attend industry events and join trade associations. Networking helps you discover new suppliers and stay competitive.

You should review your supplier agreements regularly. Look for ways to improve terms or add value. Strong supplier relationships support your store’s growth and stability.

Ongoing Grocery Store Operating Costs

When you operate a grocery store, you must plan for ongoing expenses that impact your bottom line every month. These recurring costs require careful budgeting and consistent monitoring. Understanding these expenses helps you maintain profitability and keep your operations running smoothly.

Rent or Mortgage Payments

You will likely face one of your largest fixed expenses in the form of rent or mortgage payments. Lease agreements often require monthly payments based on square footage and location. Urban areas usually command higher rates, while rural locations may offer lower costs. If you own your property, you must budget for mortgage payments, property taxes, and insurance. You should review your lease terms regularly to ensure you receive fair value. Negotiating renewal terms can help you control this expense over time.

Utilities and Maintenance

Utilities and maintenance represent essential operating costs for your store. You need to pay for electricity, water, gas, and waste removal. Refrigeration and lighting systems consume significant energy, especially in larger stores. Regular maintenance prevents equipment breakdowns and extends the life of your assets. You should schedule routine inspections for HVAC, refrigeration, and electrical systems. Addressing small issues early reduces the risk of costly repairs. Efficient inventory management also helps you optimize energy use by reducing unnecessary refrigeration and lighting.

Tip: Track your utility bills each month. Identifying trends allows you to spot inefficiencies and take corrective action quickly.

Payroll and Employee Benefits

Payroll and employee benefits make up a major portion of your ongoing expenses. You must pay competitive wages to attract and retain qualified staff. Employee benefits, such as health insurance and paid time off, add to your total payroll costs. You should use efficient inventory management to reduce labor hours spent on manual stock checks and restocking. Investing in staff training improves productivity and customer service. Monitoring your payroll closely ensures you stay within budget and maintain a motivated team.

You can manage these ongoing costs by reviewing your expenses regularly and making adjustments as needed. Staying proactive with budgeting and efficient inventory management supports the long-term success of your grocery store.

Inventory Replenishment

You must manage inventory replenishment with precision to keep your grocery store running smoothly. You need to monitor inventory levels daily and respond quickly to changes in demand. If you let shelves run empty, you risk losing customers to competitors. You should set up automated systems that track inventory and alert you when stock drops below a certain threshold. These systems help you avoid overstocking, which ties up capital and increases waste.

You can use a combination of manual checks and digital tools to maintain optimal inventory levels. Many store owners rely on inventory management software to forecast demand and schedule orders. You should review sales data regularly and adjust your inventory orders based on seasonal trends or local events. If you sell perishable goods, you must pay close attention to expiration dates and rotate stock frequently.

Consider building strong relationships with suppliers to ensure fast and reliable inventory replenishment. You can negotiate flexible delivery schedules and bulk discounts. If you diversify your supplier base, you reduce the risk of shortages and delays. You should also create a backup plan for critical inventory items in case of supply chain disruptions.

Tip: Schedule regular inventory audits to catch discrepancies early and prevent losses.

A well-organized inventory replenishment process supports customer satisfaction and boosts your store’s reputation. You can use the following checklist to streamline your approach:

- Track inventory levels daily

- Use inventory management software

- Rotate perishable inventory

- Communicate with suppliers

- Audit inventory regularly

Marketing and Community Engagement

You need a strong marketing strategy to attract new customers and build loyalty. You should invest in local advertising, such as flyers, radio spots, and social media campaigns. These channels help you reach your target audience and increase foot traffic. You can host community events, sponsor local organizations, or partner with schools to raise your store’s profile.

If you engage with your community, you create lasting relationships and encourage repeat business. You should listen to customer feedback and adjust your offerings to meet local preferences. You can launch loyalty programs or offer special discounts to reward frequent shoppers.

A clear marketing plan helps you allocate resources efficiently. You should track the results of each campaign and focus on the strategies that deliver the best return. If you build a positive reputation in your community, you lay the foundation for long-term success.

Insurance and Compliance Fees

You must budget for insurance and compliance fees as part of your ongoing operating costs. You need general liability insurance to protect your business from accidents or property damage. Many store owners also purchase workers’ compensation and product liability coverage. You should review your policies annually to ensure adequate protection.

Compliance fees include costs for permits, health inspections, and regulatory filings. You must stay up to date with local laws and renew licenses on time. If you ignore compliance requirements, you risk fines or forced closures. You should keep detailed records and consult with legal experts to avoid costly mistakes.

A proactive approach to insurance and compliance safeguards your investment and supports smooth operations.

Is the Cost to Make a Grocery Store Worth It? Profitability Insights

Typical Profit Margins

You may wonder how much profit can a grocery store make in today’s market. Most grocery stores operate on thin margins. On average, you can expect a net profit margin between 1% and 3%. This means that for every $100 in sales, your store keeps $1 to $3 as profit after covering all expenses. While this margin seems low, high sales volume can generate significant income over time. You should focus on efficient operations and strong inventory management to maximize your returns.

Note: Specialty or organic-focused stores sometimes achieve higher margins due to premium pricing, but they also face higher operating costs.

Factors Affecting Profitability

Several factors influence your store’s profitability. Location plays a major role. A high-traffic area can boost sales, but it often comes with higher rent. Your product mix also matters. Offering unique or in-demand items can attract more customers and increase your average transaction size. Efficient inventory control helps you reduce waste and avoid stockouts. Labor costs, utility expenses, and supplier relationships all impact your bottom line.

Consider these key factors:

- Store location and local competition

- Product selection and pricing strategy

- Inventory turnover rate

- Labor and utility expenses

- Supplier terms and delivery reliability

You should regularly review your financial statements to identify trends and areas for improvement.

Timeframe to Break Even

You need to plan for the time it takes to recover your initial investment. Most grocery store owners reach the break-even point within 18 to 36 months. The exact timeframe depends on your startup cost, sales growth, and expense management. If you keep your overhead low and build a loyal customer base, you may achieve profitability sooner. Tracking your monthly cash flow and adjusting your strategy helps you stay on target.

A simple break-even analysis can help you estimate your timeline:

| Startup Cost | Monthly Net Profit | Estimated Months to Break Even |

|---|---|---|

| $100,000 | $3,000 | 33 |

| $250,000 | $7,000 | 36 |

| $500,000 | $15,000 | 33 |

You should use these figures as a starting point and adjust them based on your unique business plan and market conditions.

You face a wide range of expenses when you decide to make and open a grocery store. Real estate, renovation, equipment, inventory, and staffing all require careful budgeting. You set yourself up for success by planning each step and tracking costs closely. With a clear strategy, you can build a profitable business and create lasting value in your community.

FAQ

How much money do you need to open a small grocery store?

You usually need between $10,000 and $50,000 to open a small grocery store. This budget covers rent, basic equipment, initial inventory, and permits. Costs may increase based on your location and store concept.

What licenses do you need to start a grocery store?

You must obtain a business license, health and safety permits, and a sales tax permit. Some states require additional food handling certifications. Always check with your local government for specific requirements.

How long does it take to open a grocery store?

You can expect the process to take 6 to 12 months. This timeline includes site selection, securing permits, renovations, and stocking inventory. Delays may occur due to construction or regulatory approvals.

What is the biggest expense when opening a grocery store?

Inventory and real estate usually represent your largest expenses. You must invest heavily in stocking shelves and securing a suitable location. Equipment and staffing also require significant funds.

Can you open a grocery store with no experience?

You can open a grocery store without prior experience, but you should research the industry thoroughly. Consider hiring experienced staff or seeking mentorship. Training programs and industry resources can help you succeed.

How do you keep grocery store costs low?

You can negotiate lease terms, buy used equipment, and start with a smaller store format. Build strong supplier relationships and use technology to streamline operations. Careful planning helps you avoid unnecessary expenses.

What insurance does a grocery store need?

You need general liability insurance, property insurance, and workers’ compensation coverage. Some stores also purchase product liability insurance. Consult with an insurance professional to ensure proper protection.