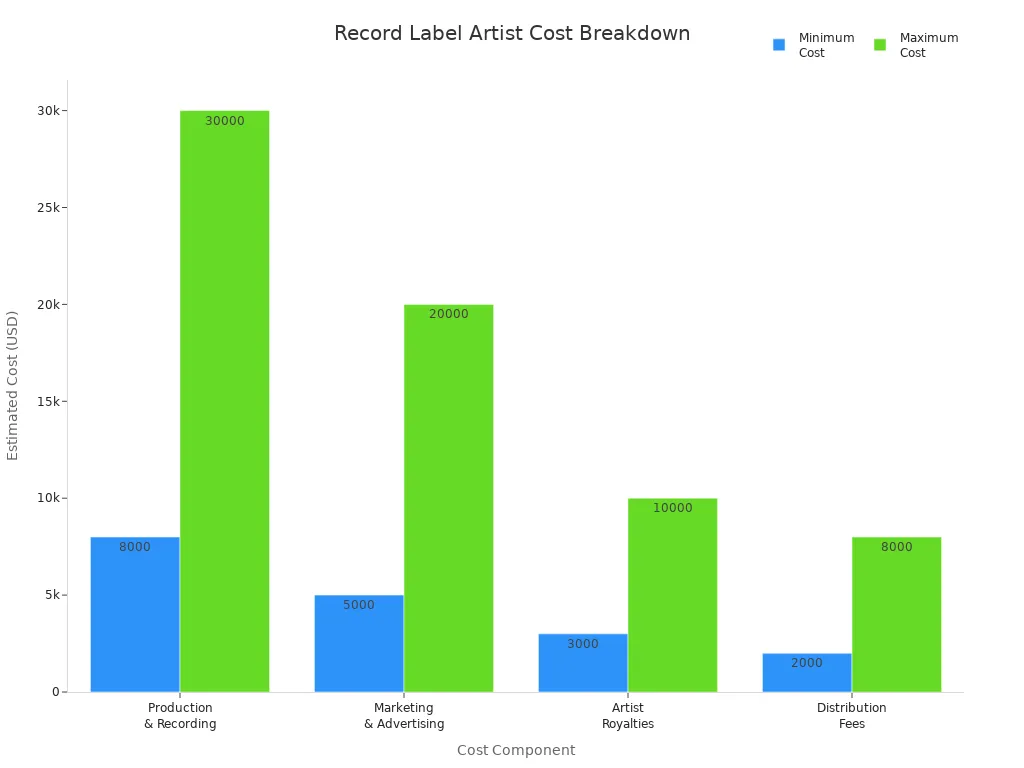

When you sign with record companies, you face a range of costs and deductions. Record labels charge you advances, production fees, marketing expenses, and royalties. The table below shows typical expenses you pay:

| Cost Component | Estimated Cost Range | Description/Notes |

|---|---|---|

| Advances | Varies widely | Upfront recoupable payments, depend on artist buzz and label size |

| Production & Recording | $8,000 – $30,000 | Studio time, equipment rental, session musicians |

| Marketing & Advertising | $5,000 – $20,000 | Digital ads, social media campaigns, promotional tours |

| Artist Royalties | $3,000 – $10,000 | Paid based on sales and streaming performance |

| Distribution Fees | $2,000 – $8,000 | Costs for physical/digital distribution |

You pay for advances upfront, and record companies recoup these before you earn royalties. Net royalty income often drops to 40-50% of net profits after deductions. Whether you work with major record labels or smaller record companies, you must watch for hidden fees, much like how Electronic Shelf Labels and ESL Price Tag systems help retailers clarify pricing. Esl Retail and ESL Gateway AP also streamline cost transparency, but you need to understand how record labels charge to protect your earnings.

How Record Labels Charge Artists

Understanding how record labels charge you is essential before you sign any contract. The way record companies pay artists depends on the type of deal, the label’s size, and the specific terms you negotiate. You need to know the typical percentages, revenue splits, and what you can expect to take home after all deductions.

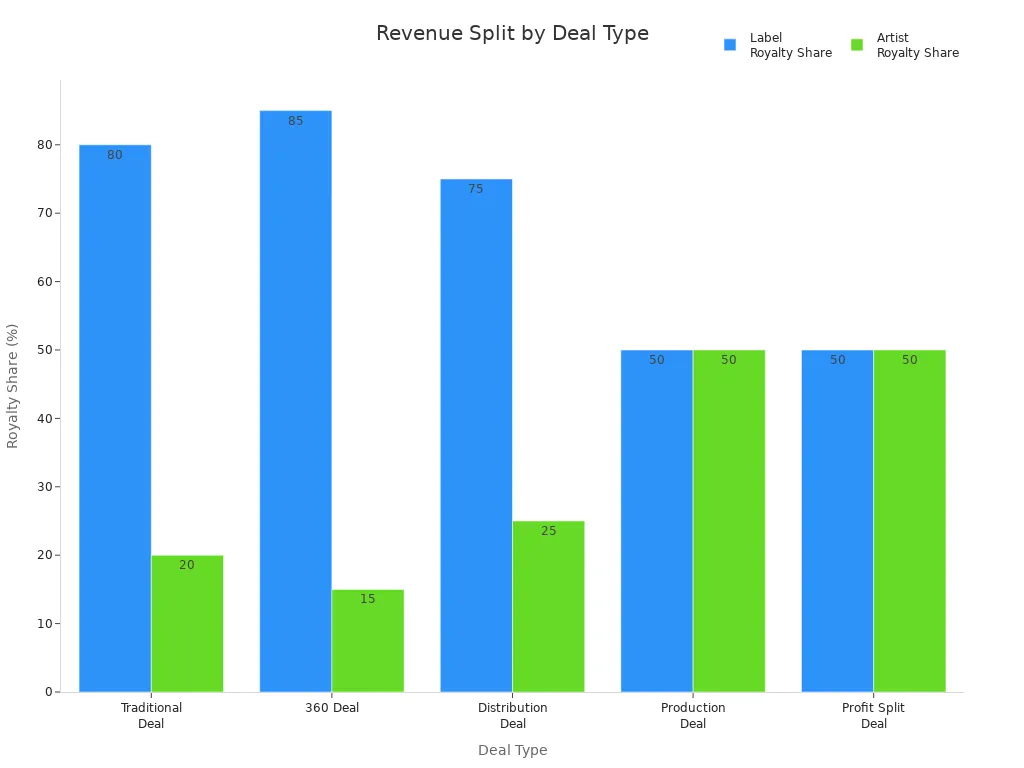

Typical Percentages and Revenue Splits

When you look at how record labels charge, you will see a wide range of revenue splits. The type of deal you sign determines how much you actually get paid. Here is a table that breaks down the most common deal types and their revenue splits:

| Deal Type | Label Royalty Share | Artist Royalty Share | Advance | Recoupable Costs | Masters Ownership |

|---|---|---|---|---|---|

| Traditional Deal | ~80% | ~20% | Yes | Advance, Recording Costs | Label |

| 360 Deal | 85% | 15% | Yes | All costs (touring, marketing, recording, etc.) | Label |

| Distribution Deal | 75% | 25% | Sometimes | Recording, Marketing | Artist |

| Production Deal | 50% | 50% | No | Recording | Producer |

| Profit Split Deal | 50% | 50% | Yes | Recording, Marketing, Other expenses | Label |

Major Label Charges

Major record labels charge you some of the lowest royalty rates in the industry. You often see royalty percentages below 18%. These companies pay large advances, but they also recoup every dollar they spend on your behalf. You rarely own your masters, and the contracts can be complex. Major labels control about 65-70% of the market revenue and pay artists an average of $3.4 million per artist, but only after deducting all costs. You get access to big marketing budgets and industry connections, but you give up creative control and a large share of your earnings.

Indie Label and Small Label Splits

Independent record labels and small companies usually offer more artist-friendly deals. You often see a 50/50 revenue split, and you may keep ownership of your masters. Indie labels pay artists higher royalty rates and give you more creative freedom. The contracts are simpler and more transparent. Indie labels focus on grassroots marketing and personalized support, but they have smaller budgets and less industry influence. The average revenue per artist is about $352,000, which is lower than major labels, but you keep a larger share of what you earn.

Tip: Always compare the revenue splits and contract terms before you sign. A higher royalty rate with an indie label can sometimes pay more than a lower rate with a major label, especially if you retain ownership of your music.

Real-World Examples of Artist Earnings

You need to look at real-world cases to understand how record labels charge and pay artists. The numbers on paper do not always match what you actually receive.

Case Study: Major Label Deal

Many artists dream of signing with a major label, but the reality can be harsh. For example, 30 Seconds To Mars sold millions of records worldwide, but the band ended up millions in debt and never received payment at first. They had to sue their label, EMI, before renegotiating their contract. Courtney Love once wrote that large advances often leave artists owing money because record companies recoup every cost before they pay artists any royalties. According to music-business consultant Moses Avalon, only about 0.0465% of artists signed to major labels ever achieve real success. Most never release an album, and some get signed only to be shelved, preventing competition.

Case Study: Indie Label Deal

Independent artists and labels have seen rapid growth in recent years. In 2023, indie music accounted for 50% of Spotify’s payouts, totaling $4.5 billion. The independent sector now holds a 36.09% market share, even surpassing Universal Music Group’s 29.35%. Indie artists benefit from multiple income streams, such as direct fan support, merchandise, licensing, and live shows. The rise of streaming platforms like Spotify and YouTube has made it easier for indie artists to reach global audiences and get paid directly. Billie Eilish’s early career shows how you can build a massive following independently before working with a major label for distribution.

Note: Indie labels pay artists a larger share of revenue, and the growth rate for indie music outpaces that of major labels. You can achieve financial stability and creative freedom if you choose the right deal.

Advances and Recoupment in Record Labels

How Advances Work for Artists

When you sign a record deal, the label often gives you an advance. This upfront payment helps you cover recording costs and living expenses while you create music. Advances are not personal loans. You do not owe the label money out of pocket if your music does not sell. Instead, the label recoups the advance by withholding royalty payments until your earnings match the amount advanced.

Average Advance Amounts

Record labels structure advances based on your projected sales and bargaining power. You may see a wide range of advance amounts depending on the label’s size and your market value. Here is a breakdown of typical advance amounts:

| Advance Amount Range | Typical Artist Revenue / Metrics | Common Uses |

|---|---|---|

| $10,000 – $25,000 | Monthly revenue $1,000–$2,000 | Marketing, single/album production |

| $50,000 – $100,000 | Monthly revenue $5,000+ | Extensive touring, PR campaigns |

| $100,000+ | High revenue and strong metrics | Long-term growth, large-scale projects |

You might receive an advance at signing and again when the label exercises options for future albums. Labels often include a recording fund in the advance, which pays for studio time and production. Any leftover funds go directly to you.

Repayment and Recoupment Process

The recoupment process starts as soon as your music generates revenue. The label deducts your advance from royalties earned through album sales, streaming, and sometimes merchandise. You only begin to receive royalty payments after the label recoups the full advance. For example, if you earn $100,000 in royalties and your advance was $50,000, the label will pay you the remaining $50,000 after recoupment. Labels may also recoup other expenses, such as marketing and video production, before they pay artists additional royalties.

Tip: Larger advances often come with lower royalty rates. Smaller advances may allow you to negotiate higher royalties and reduce financial pressure.

Impact of Recoupment on Royalties that Music Artists Make

Recoupment directly affects how much you take home from your music. You must understand how this process impacts your earnings before you sign a contract.

What Happens If Sales Don’t Cover the Advance

If your music does not generate enough sales to cover the advance, you do not pay the label back out of pocket. The label absorbs the loss, but you will not receive further royalty payments until you recoup the advance. This situation can delay your income and create financial strain. Labels sometimes use cross-collateralization, combining advances from multiple projects, which can extend the repayment period and further impact your earnings.

Advance vs. Actual Take-Home Earnings

Your actual take-home earnings depend on how quickly you recoup the advance. The label pays artists only after recoupment is complete. You may wait years before you see royalty payments, especially if the label recoups other costs like marketing and production. The label usually owns the master recordings, controlling distribution and licensing. You must manage your finances carefully and negotiate contract terms to protect your income.

- Advances are not personal debt.

- Recoupment delays royalty payments.

- Labels pay artists only after recovering all costs.

Note: You should always review your contract and consult a music attorney before signing. Understanding advances and recoupment helps you make informed decisions and avoid financial surprises.

Royalty Rates and Royalties that Music Artists Make

Standard Royalty Percentages from Record Labels

Major vs. Indie Label Royalty Rates

You will find that royalty rates differ greatly between major and indie record labels. Major labels usually offer lower artist royalties, often between 10% and 16% for new artists. These companies keep a large share of the revenue, sometimes up to 90% of net sales. Indie labels, on the other hand, tend to provide more artist-friendly deals. You might see profit splits as high as 50/50, or even more favorable arrangements where you keep 65% and the label takes 35%. Some mid-size indies offer royalty rates between 50% and 75%. If you release music independently, you can keep nearly all your earnings, minus a small distributor fee.

| Label Type | Typical Royalty Percentage to Artist | Label’s Share Range | Notes |

|---|---|---|---|

| Major Labels | 10-20% | Up to 90% | Label recoups investment costs, owns masters |

| Mid-size Indies | 50-75% | 25-50% | More favorable to artists, less control by label |

| Indie Labels | 50% or higher | 50% or lower | Often profit-share, sometimes artist-owned masters |

| Independent Musicians | Nearly 100% (minus distributor fees) | <15% | Full control, distributor takes a small percentage |

If you want more control and a higher share of royalties, indie labels or self-releasing may suit you better.

How Royalties Are Calculated

Record royalties depend on your contract type. In a traditional deal, you receive a substantial advance, but the label owns your masters and recoups costs before paying you. The royalty split is often 80/20 in favor of the label. In a 360 deal, the label takes a percentage of all your revenue streams, including touring and merchandise. Profit split deals usually offer a 50/50 split after recoupment. Distribution deals let you keep more, often 75% or more, since you own your masters.

| Contract Type | Advance | Ownership of Masters | Royalty Split After Recoupment | Recoupment Scope |

|---|---|---|---|---|

| Traditional Record Deal | Yes | Label | 80/20 (label/artist) | Advance and recording costs |

| 360 Deal | Yes | Label | Label takes % of all revenue | Advance, recording, marketing, touring |

| Profit Split Deal | Yes | Label | 50/50 split | Advance and all other expenses |

| Distribution Deal | Sometimes | Artist | 75/25 (artist/label) | Depends on contract |

You should always check how the label calculates royalties that music artists make. Some contracts base royalties on net sales, while others use gross revenue. The calculation method can change your final earnings.

Deductions from Royalties

Packaging, Reserves, and Reductions

Labels apply several deductions before you receive your royalty payments. Packaging deductions cover the cost of physical packaging and shipping. These usually range from 15% to 30% of your royalty rate. For example, if your royalty rate is 12% and the packaging deduction is 25%, your effective rate drops to 9%. Labels also hold back reserves, especially for physical sales, to protect against retailer returns. A reserve might be 20% of your royalties, delaying part of your payment until the label confirms actual sales.

| Sales Amount | Royalty Rate | Gross Royalty | Reserve % | Reserve Amount | Paid to Artist Now | Packaging Deduction % | Deduction Amount | Final Royalty Paid |

|---|---|---|---|---|---|---|---|---|

| £1,000 | 25% | £250 | 20% | £50 | £200 | 15% | £37.50 | £212.50 |

You will also see reductions for discounted sales, international sales, and promotional copies. These deductions can lower your actual royalty costs and delay your income.

Mechanical Royalties and Songwriter Splits

Performance royalties and mechanical royalties are two key types of music income. Performance royalties pay you when your music is played on radio, TV, or live venues. Mechanical royalties pay you for each copy of your song sold or streamed. If you write your own songs, you receive songwriter splits in addition to artist royalties. Labels often pay mechanical royalties separately, and these payments go to songwriters and publishers. You should track both performance royalties and mechanical royalties to maximize your total earnings.

Always review your contract for details on royalty deductions and splits. Understanding these terms helps you avoid surprises and ensures you receive fair compensation for your work.

Recording and Production Costs Charged by Record Labels

Studio Time and Production Expenses

Recording costs represent one of the largest investments you face when working with a record label. You must budget for studio time, equipment, and production services. The price varies depending on the studio’s quality and location.

| Cost Category | Typical Cost Range | Notes |

|---|---|---|

| Studio Time (Basic/Home) | $30 – $50 per hour | Suitable for smaller or home studios |

| Studio Time (Professional) | $50 – $150 per hour | Standard professional studios |

| Studio Time (World-Class) | $300+ per hour | High-end facilities in major music markets |

| Studio Setup Investment | $30,000 – $70,000 | Equipment and soundproofing for professional studios; premium setups exceed $100,000 |

| Production per Single | $1,000 – $5,000+ | Includes music production, mixing, and mastering |

| Production per Album | $5,000 – $20,000+ | Full album production costs vary by quality and personnel |

| Production Cost per Song | $500 – $5,000+ | Depends on producer experience and studio quality |

| Mixing and Mastering per Song | $150 – $700 | Combined cost; mastering alone ranges from $50 to $200 per song |

You may encounter basic recording sessions costing around $500 per day. Specialized equipment or unique production techniques can increase your expenses by 150% or more. Emerging labels often budget $20,000 to $50,000 for reliable recording equipment. Soundproofing and acoustic treatments typically account for 15%-25% of initial studio setup costs. Regular updates and repairs may require 10%-20% of initial equipment costs annually.

Label-Funded vs. Artist-Funded Recording

You need to understand who pays for recording costs and how this affects your earnings. In label-funded deals, such as traditional or 360 contracts, the label covers all recording, production, and marketing costs upfront. These expenses are recouped from your royalties, which often results in higher total costs and longer recoupment periods. If you choose an artist-funded deal, like a distribution or licensing agreement, you pay for recording and production costs yourself. This approach leads to lower total expenses for the label and allows you to recoup costs faster since the label or distributor takes a smaller revenue share. Joint venture deals split expenses and profits equally, while 360 deals recoup from multiple income streams, potentially speeding up recoupment but reducing your income share.

Tip: Artist-funded recording costs offer you more control and quicker recoupment, but you must manage your budget carefully.

Recoupable vs. Non-Recoupable Costs

Record labels classify expenses as either recoupable or non-recoupable. Recoupable costs include studio time, production, mixing, mastering, and music video expenses. The label deducts these from your future royalties until they recover their investment. Non-recoupable costs, such as certain promotional fees or administrative charges, do not get deducted from your royalties. You should always clarify which costs are recoupable in your contract to avoid surprises.

Additional Production Charges

You must account for extra production charges that appear in most record label contracts. These costs go beyond basic recording and can impact your overall profitability.

| Production Charge Type | Typical Cost Range (USD) |

|---|---|

| PR and Publicity Services | $500 to $2,500+ per month |

| Playlist Pitching Services | $500 to $1,500 per campaign |

| Press Release Distribution | $275 to $500 per release |

| Graphic Design | $230 to $700 per project (album artwork) |

| Videography (Music Videos) | $600 to $3,500+ per project |

| Photography | $200 to $1,500 per session |

| Licensing and Royalty Setup Fees | $100 to $1,000 upfront |

Mixing, Mastering, and Session Musicians

Mixing and mastering costs range from $150 to $700 per song. Mastering alone can cost $50 to $200 per track. You may also need to hire session musicians, which adds to your recording costs. These professionals charge by the hour or per project, and their fees depend on experience and demand.

Music Video and Visual Content Costs

Music video production represents a significant expense. Videography costs can range from $600 to $3,500 or more per project. Labels invest in VEVO-related costs, including channel setup and marketing campaigns, to maximize your video reach. These expenses vary widely, with established artists sometimes requiring six-figure budgets. Labels recoup these costs from your future royalties, which increases your financial burden and affects your net income.

Note: Transparency about additional production charges and their recoupment is essential. Always review your contract to understand how these costs impact your earnings.

Promotion, Marketing, and Distribution Fees from Record Labels

Marketing Budgets and Promotional Charges

What’s Included in Promotion

You encounter a wide range of promotional activities when you work with a record label. Labels invest in digital advertising, social media campaigns, music video production, radio plugging, influencer partnerships, and press releases. Major record labels spend about $2.5 million per artist on marketing, according to IFPI data. Breaking a new artist often requires a budget of $150,000 to $200,000, as noted by Wendy Day of RapCoalition. Smaller campaigns, usually under $10,000, target artists with an existing fan base and focus on local advertising or grassroots social media efforts.

| Record Label Type | Marketing Budget Range | Typical Marketing/Promotion Activities |

|---|---|---|

| Small Independent Label | $2,000 – $4,000 | Local advertising, social media campaigns, artist showcases |

| Mid-Sized Label | $5,000 – $10,000 | Digital marketing, branding, music videos, online presence |

| High-End/State-of-the-Art | $25,000 – $50,000 | Global marketing campaigns, high-end branding, celebrity endorsements |

You see labels allocate 5% to 15% of their revenue to marketing budgets. New or smaller labels usually start at the lower end. These funds support music production, digital content creation, and targeted promotional campaigns.

How Marketing Costs Are Recouped

Record labels treat marketing and promotional costs as advances. You receive these funds upfront, but the label recoups them from your future royalties. Your royalty account tracks these expenses. The label withholds your share of sales until you repay the total advance, including marketing costs. You do not pay the label directly. Instead, your royalties fill a “bucket” that must reach the advance amount before you receive additional payments. Labels often use cross-collateralization, allowing them to recoup costs from any of your projects. This system ensures the label recovers its investment before you profit from royalties.

Tip: Always review your contract for details on how marketing costs are recouped. Understanding this process helps you manage expectations and avoid surprises.

Distribution and Administration Fees

Digital and Physical Distribution Costs

You face several fees when your music reaches listeners. Physical distribution involves pressing vinyl, CDs, and cassettes. Labels typically pay manufacturing costs, which vary by product type and packaging. Distribution fees for physical releases often reach 25% of the wholesale price. You do not pay upfront to secure a physical distribution deal. Retailers take a cut from the difference between wholesale and retail prices. Labels may pay return processing fees for unsold CDs, while vinyl is usually non-returnable.

| Aspect | Details |

|---|---|

| Distribution Fee (Physical) | 25% of wholesale price |

| Manufacturing Costs | Paid by label; varies by product and packaging |

| Return Processing Fees | Fees for returned CDs; vinyl usually non-returnable |

| Retailer Cut | Difference between wholesale and retail price |

| Pricing Guidance | CDs: $8-$16; LPs: $17-$26 (retail prices) |

Digital distribution involves platform fees and service charges. You must account for returns from distributors and retailers, which can impact your profits. Managing inventory and choosing the right channels help you control costs.

- Physical production costs include pressing and packaging.

- Digital distribution requires platform fees and service charges.

- Returns and inventory management affect your net income.

Administrative Deductions and Third-Party Charges

Administrative deductions reduce your net income. You pay commissions, legal fees, and operating expenses, often through a loan out corporation. For example, if your corporation receives $135,000 from a label, pays $10,000 in expenses and $25,000 into a pension plan, your net income before salary drops to $100,000. You then receive this as personal income. This structure allows you to defer taxes and deduct business expenses at the corporate level. Third-party charges, such as agent commissions and legal fees, become tax-deductible when paid by your corporation. These deductions lower your taxable income and net income after taxes.

Note: Setting up a loan out corporation and electing Subchapter S status can help you manage administrative deductions and third-party charges. This approach preserves your rights and maximizes your financial benefits.

Hidden and Additional Charges in Record Label Deals

Common Hidden Fees Artists Face

When you sign a record label contract, you encounter several hidden fees that can dramatically reduce your earnings. You need to watch for these charges, as they often appear in the fine print and can impact your bottom line.

- Overhead fees cover the label’s operational costs, such as salaries and office rent. These fees typically range from 3% to 5% of your gross earnings, but some labels charge up to 10%.

- Distribution fees reach up to 10% of gross revenue. Labels deduct these fees to cover the cost of getting your music onto streaming platforms and manufacturing physical copies.

- Both overhead and distribution fees are subtracted before profit splits, which means you receive a smaller share of your earnings. For example, if your album generates $3 million in gross revenue, combined overhead and distribution fees can reduce your net income from $1.2 million to $900,000.

- Recoupable expenses include advances, recording costs, and marketing. You must repay these expenses before you earn any royalties, often requiring high sales or streams to break even.

- Unrecouped balances can carry over to future albums, increasing your financial burden and delaying your income.

- Royalty rates vary by territory. You might earn 20% in the US, but only 14% in Japan, further reducing your effective earnings.

Legal and Contractual Costs

You face legal and contractual costs when negotiating and maintaining your record deal. Labels often require you to pay for your own legal representation, which can cost thousands of dollars. You also pay for contract drafting, review, and negotiation. These expenses are rarely recoupable and come out of your pocket. If you do not understand the contract terms, you risk agreeing to unfavorable clauses that limit your earnings and creative control.

Merchandising and Branding Deductions

Labels frequently deduct fees for merchandising and branding. You may see deductions for logo design, merchandise production, and brand management. These costs reduce your share of merchandise sales and can lower your overall income. Some contracts allow labels to control your branding decisions, which limits your ability to negotiate better deals with third parties.

Penalties and Unusual Clauses

Record label contracts often include penalties and unusual clauses that affect your earnings. You must understand these terms before signing.

Cross-Collateralization Explained

Cross-collateralization allows labels to recoup advances and costs from multiple income streams, not just record sales. If you owe money from one album, the label can deduct from your publishing, touring, and merchandise revenue. This clause makes it harder for you to break even and delays royalty payments across all projects.

| Clause Type | Description | Impact on Artist Earnings |

|---|---|---|

| Advances/Recording Funds | Label provides advances for recording, but limits future advances if prior ones are not recouped. | Restricts funding for future projects, reducing your ability to invest in new music. |

| Recoupment | Advances and costs are recouped from all royalties before payout. | Delays or reduces your earnings until all costs are recovered. |

| Cross-Collateralization | Label recoups advances from multiple income streams. | Reduces your earnings from publishing, touring, and merchandise, not just record sales. |

| All-in Royalties | Artist royalties include producer payments. | Lowers your net royalty rate, as you pay producers from your share. |

| Reserve Against Returns | Label withholds royalties to cover product returns, releasing funds over time. | Delays your royalty payments and affects cash flow. |

| Publicity Clauses | You must participate in promotional activities without extra pay. | Increases your unpaid workload and personal expenses, reducing net income. |

Audit and Accounting Fees

You may need to audit your label’s accounting to ensure accurate royalty payments. Labels often charge fees for audits and accounting services. These costs can be substantial, especially if you suspect underpayment. You pay for legal and financial experts to review statements and challenge discrepancies. If you do not audit regularly, you risk losing income due to errors or hidden deductions.

Tip: Always review your contract for hidden fees and unusual clauses. Consult a music attorney to protect your rights and maximize your earnings.

Comparing Record Labels and Deal Structures

Major Labels vs. Independent Record Labels Charge

Typical Cost Differences

You face significant differences in costs and deal structures when comparing major record companies to independent ones. Major record companies often offer large advances, typically between $150,000 and $300,000. In contrast, independent record companies usually provide smaller advances, sometimes as low as $5,000 or just enough to cover recording costs. Both types of companies may offer similar royalty rates, around 10-15% of the Standard Retail List Price, but major companies apply more deductions, such as packaging and foreign sales. Independent companies often use profit-sharing deals, allowing you to receive 40-75% of net profits after recouping expenses.

| Aspect | Major Record Companies | Independent Record Companies |

|---|---|---|

| Advances | $150,000-$300,000 | $5,000-$125,000 or just recording costs |

| Royalties | 10-15% SRLP, many deductions | 10-15% SRLP or 40-75% profit-sharing |

| Deductions | Multiple, complex | Fewer, simpler |

| Free Goods | 10-15% for promotion | Often more, no royalties on these |

| Contract Terms | Multi-album, options favor label | More flexible, buy-out clauses possible |

| Publishing & Merch | Usually excluded, separate deals | Often included, co-publishing possible |

| Deal Types | Traditional, rare profit-sharing | Profit splits, joint ventures, licensing, partnerships |

Independent companies frequently offer more flexible deal types, including joint ventures and licensing agreements. These structures give you more control and a larger share of profits, especially if you understand the different types of music licenses available.

Pros and Cons for Artists

Choosing between major and independent record companies involves weighing several pros and cons:

- Major companies provide extensive resources, professional support, and global distribution. You gain access to established networks and large marketing budgets.

- You may lose creative control and accept lower revenue shares with major companies. Long-term contracts can restrict your career options.

- Independent companies offer greater artistic freedom and more personal relationships. You often benefit from flexible contracts and higher profit shares.

- You must handle limited budgets and smaller networks with independent companies. You also bear more financial risk for production and promotion.

| Factor | Independent Artist | Signed with Record Company |

|---|---|---|

| Resources & Budget | Limited funding for mastering, marketing, touring | Access to company’s resources and budget |

| Network & Connections | Smaller fanbase and industry contacts | Established network with promoters, agents, media |

| Creative Control | Full control over music and brand | Limited control; company may decide without your approval |

| Revenue & Profits | Keeps 100% of profits | Company takes percentage; often fewer profits for artist |

| Contract Terms | No restrictive contracts | Long-term contracts; possible unfavorable terms |

| Time & Effort | Manages all aspects, time-consuming | Company handles business, you focus on music |

Think of major companies as professional gardeners with every tool and resource, while independent artists act as gardeners who manage everything themselves. You must decide which approach fits your goals and resources.

Alternative Deals and Self-Releasing

Distribution and Licensing Deals

You have more options than just signing with traditional record companies. Distribution and licensing deals allow you to keep ownership of your music and choose from different types of music licenses. Distribution platforms like DistroKid, TuneCore, and CD Baby offer affordable pricing. For example, DistroKid charges $19.99 per year for unlimited releases, and CD Baby takes a one-time fee plus a small commission. These services let you keep 100% ownership and select the types of music licenses that fit your needs.

| Deal Type | Advance Amount | Revenue Split (Artist:Company) | Ownership of Masters | Contract Length | Additional Notes |

|---|---|---|---|---|---|

| Traditional JV | $600,000 | 30% : 70% after recoupment | Company owns masters | 3 years + share | Long-term, less control |

| Distribution Deal | $400,000 | 80% : 20% distribution fee | Artist retains masters | 7 years | More control, lower costs |

| Financing Deal | $400,000 | 70% : 30% (repayment) | Artist retains masters | Not specified | Flexible, fixed repayment |

You can also explore artist and label services companies, which provide marketing, royalty collection, and funding. These services offer flexible contracts and let you choose the types of music licenses that match your career stage.

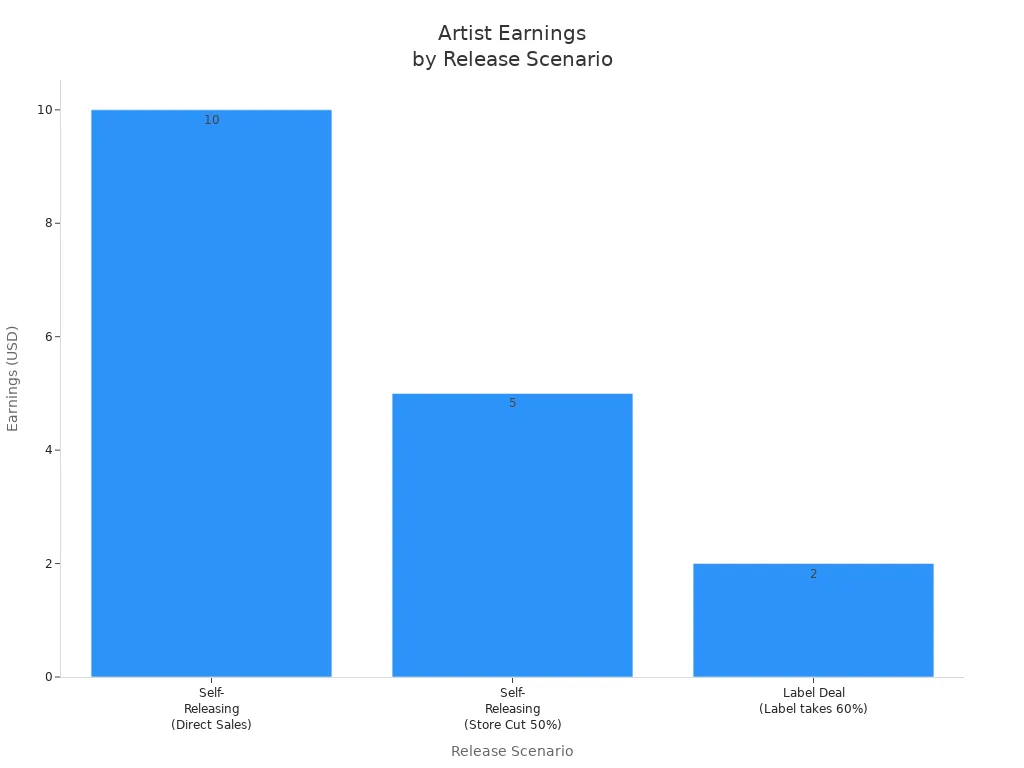

When Self-Releasing Makes More Sense

Self-releasing your music can make financial sense if you want to keep all profits, retain master rights, and maintain creative control. You avoid complex contracts and advances that must be repaid before you see royalties. You also choose the types of music licenses that work best for your projects.

If you receive a large advance, remember that you must repay it before earning royalties. Some artists never see royalty checks because the company recoups all costs first.

- You keep 100% of your profits and own your master rights.

- You avoid restrictive contracts and maintain full creative control.

- You must handle marketing, distribution, and administration yourself.

- Self-releasing works best if you understand the business and the types of music licenses available.

| Scenario | Sales | Price per Sale | Artist’s Share | Artist’s Earnings |

|---|---|---|---|---|

| Self-Releasing (Direct Sales) | 10 | $1 | 100% | $10 |

| Self-Releasing (Store Cut 50%) | 10 | $1 | 50% | $5 |

| Label Deal (Label takes 60%) | 10 | $1 | 20% | $2 |

You should consider self-releasing if you want to maximize your earnings, control your brand, and manage the types of music licenses for your work.

You face many costs when you work with a record label. After all deductions, your royalties often shrink, and you may wait years before you see real income. You must determine what you should pay by reviewing every contract detail. Always read the fine print, compare deal structures, and consult a music attorney before you sign.

| Contract Element | Description & Importance |

|---|---|

| Advances | Upfront payments you must pay back through future royalties. |

| Royalties / Revenue Share | Your share of earnings after the label deducts costs. |

| Key Clauses | Terms like 360 deals and cross-collateralization can affect how much you pay and control your music. |

1. Prepare by understanding industry standards and clarifying your goals. 2. Negotiate all terms, including royalties and ownership. 3. Secure legal representation to protect your rights. 4. Research the label’s reputation and track record.

You should weigh the financial pros and cons of working with a label versus going independent. Careful planning helps you pay only what is fair and maximize your royalties.

FAQ

What is a recoupable expense in a record label contract?

A recoupable expense is money the label spends on your behalf, such as recording or marketing. The label deducts these costs from your future royalties before you receive payment.

How do advances from record labels affect your earnings?

You receive an advance upfront. The label recoups this amount from your royalties. You only start earning royalties after you pay back the advance through sales or streams.

Do you always lose ownership of your music when signing with a label?

Major labels usually keep master ownership. Indie labels sometimes let you retain rights. Always review your contract to understand who owns your music after signing.

What are typical royalty rates for artists?

Major labels pay 10% to 20%. Indie labels offer 50% or higher. Self-releasing allows you to keep nearly all earnings, minus distributor fees.

Can you negotiate contract terms with a record label?

You can negotiate advances, royalty rates, and ownership. Hiring a music attorney helps you secure better terms and protects your interests.

What hidden fees should you watch for in record label deals?

Watch for overhead, distribution, legal, and merchandising fees. These charges reduce your net income. Always read the fine print and ask questions before signing.

Is self-releasing music a good option for new artists?

Self-releasing gives you full control and higher profits. You handle marketing and distribution yourself. This option works best if you understand the business side of music.