Shelf companies cost varies widely, ranging from $250 to over $10,000 depending on age, jurisdiction, and added services. The table below highlights typical price points in Wyoming:

| Company Age / Feature | Price Range (USD) | Notes |

|---|---|---|

| Newly formed (2021) | $645 | Cheapest shelf companies |

| Older companies (2007) | $4,895 – $5,000 | Higher price due to age and EIN status |

Main cost factors include purchase price, annual fees, and hidden expenses. Shelf company buyers must consider due diligence, legal review, and the risk of inheriting liabilities. Shelf companies cost about the same as forming a new company, but they offer faster access to operational readiness. Many believe shelf companies guarantee easy credit, yet banks often require more than company age. Understanding every shelf company expense helps buyers avoid costly mistakes. The Electronic Shelf Labels market, ESL Gateway AP, ESL Price Tag, and Esl Retail trends also influence demand and pricing strategies.

What Is a Shelf Company?

Shelf Company Definition

A shelf company refers to a business entity that has been legally incorporated but remains inactive, with no commercial activity since its formation. Professionals often call these entities shelf corporations or ready-made companies. Providers create shelf companies and leave them dormant, allowing them to age on the “shelf” until a buyer seeks immediate operational readiness. Shelf corporations possess an established legal structure and filing history, which can project credibility and professionalism.

Unlike newly formed companies, shelf corporations offer immediate authority to conduct business. They come with a proven track record, often spanning several years, which can improve credit ratings and facilitate contractual agreements. Shelf companies differ from new entities in several ways:

- Shelf companies are pre-incorporated and dormant, enabling instant transfer of ownership and immediate business operations.

- Shelf corporations have an established age, which can help secure loans and attract investors.

- Shelf companies may require updates or restructuring to align with new owners’ goals, limiting flexibility in branding or legal structure.

- New companies provide full control over structure and branding but require time for registration and credibility building.

Shelf corporations allow buyers to bypass lengthy incorporation processes, offering a shortcut to operational readiness and a reputable history.

Why Buy a Shelf Company?

Business owners choose shelf companies for several strategic reasons. Shelf corporations provide instant availability, allowing entrepreneurs to start operations without delay. The established incorporation date enhances credibility and trustworthiness, which can be crucial when bidding on contracts or seeking financing.

Key motivations for purchasing a shelf company include:

- Immediate operational readiness, avoiding administrative delays.

- Enhanced reputation due to proven longevity and filing history.

- Eligibility for contract bidding where company age is a requirement.

- Faster access to credit and financing, as banks often view older shelf corporations as lower risk.

- Expedited international expansion or acquisitions by bypassing regulatory barriers.

- Boosted investor confidence and market perception through a ready-made company with a filing history.

Shelf companies also enable eligibility for contracts and financing that require a minimum company age. Entrepreneurs often use shelf corporations to present a mature business image to investors and clients. However, buyers must conduct thorough due diligence to avoid hidden financial or legal issues. Customization of shelf companies can be limited, such as restrictions on changing company names or legal structure.

Shelf corporations save time and provide a competitive edge in markets where company age and reputation matter. They offer a practical solution for those seeking immediate business authority and access to opportunities that new companies cannot reach.

Shelf Companies Cost Breakdown

Purchase Price Factors

Age and Shelf Corporation Cost

The age of a shelf company stands as one of the most significant drivers of price. Older shelf companies command higher prices because they offer a longer filing history and greater perceived credibility. For example, a 14-year-old shelf company may cost around $2,695, while a 5-year-old company might be priced at $1,500. Buyers often seek older shelf corporations to reduce the risk of business failure and to present a mature image to clients or lenders. However, purchasing a shelf company with an existing Employer Identification Number (EIN) can introduce risks, such as back taxes or undisclosed debts. Experts recommend avoiding shelf corporations with existing EINs to prevent inheriting financial liabilities.

Tip: Always verify the company’s history and ensure it has remained dormant and compliant throughout its existence.

Jurisdiction and Location Impact

Jurisdiction plays a crucial role in determining shelf companies cost. Different regions offer varying regulatory environments, business climates, and reputational advantages. For instance, fintech-friendly jurisdictions like the UK, Ireland, Estonia, and Lithuania attract buyers seeking innovation and regulatory support. In the United States, states such as Wyoming and Nevada remain popular due to business-friendly laws and privacy protections. However, shelf corporation cost can rise in jurisdictions with higher compliance standards or greater international recognition.

| Factor | Influence on Purchase Price |

|---|---|

| Age of Corporation | Older companies generally have higher prices due to established history and credibility. |

| Included Services | Legal support, administrative handling, and strategic planning assistance can increase the cost. |

| Custom Requirements | Specific client requests or customizations may affect the final price. |

| Jurisdiction | Different regulatory environments and business climates impact desirability and value. |

| Company History | Clean legal standing and absence of liabilities are crucial for pricing and buyer confidence. |

Buyers should also consider the transparency and reputation of the vendor. Overpaying for a shelf company often results from a lack of legal protections or insufficient due diligence.

Credit Profile and Company History

A shelf company’s credit profile and operational history directly affect its value. Shelf corporations with a clean record—no unpaid taxes, debts, or legal disputes—are more desirable and command higher prices. Buyers should confirm, in writing, that the company has no outstanding liabilities. A transparent history increases buyer confidence and reduces the risk of future complications.

- Verify the seller’s identity and reputation.

- Confirm guarantees about the company’s past liabilities.

- Ensure the shelf company has a clean history with no back taxes, debts, or liabilities.

- Prefer companies maintained without dissolution and with a clear record.

- Conduct thorough due diligence to avoid legal and financial issues.

Ongoing and Annual Fees

Renewal and Maintenance Costs

After acquiring a shelf company, owners must budget for ongoing expenses. The annual renewal fee covers government charges and service provider costs to keep the company in good standing. These fees vary by jurisdiction and can include state or national filing fees, as well as administrative charges. For example, in Anguilla, the annual renewal fee for a company with authorized capital up to $50,000 is approximately $750. In Belize, the annual renewal fee is due every April 30, regardless of the incorporation date. In the United States, annual renewal fee schedules depend on the state, with penalties for late payments.

| Jurisdiction | Annual Fees (Government + Agent) | Renewal Deadline | Penalty for Late Payment | Penalty Escalation Timeline | Additional Fees |

|---|---|---|---|---|---|

| Anguilla | Approx. $750 | Quarterly | 10% after 1 day late | 50% after 3 months; struck off after 6 months | Registered agent fees, nominee fees, mail forwarding fees, restoration fees ($300-$600) |

| Belize | Varies | April 30 | Penalties apply | N/A | N/A |

| US (Nevada) | Varies by state | Incorporation month end | Penalties apply | N/A | Registered agent fees, restoration fees if struck off |

Note: Missing the annual renewal fee deadline can result in escalating penalties and, eventually, the company being struck off the register.

Registered Agent and Nominee Fees

Shelf companies require a registered agent to receive legal documents and maintain compliance. Registered agent fees are typically included in the first year’s purchase price, but owners must pay them annually thereafter. Some buyers also use nominee services to protect privacy or meet local director requirements. Nominee fees add to the total shelf companies cost and vary based on the jurisdiction and level of service.

Mail Forwarding and Virtual Office Expenses

Many shelf corporations operate in jurisdictions where a physical presence is not required. Service providers often offer mail forwarding and virtual office solutions as part of their packages. These services ensure that official correspondence reaches the owner and that the company maintains a local address. Mail forwarding and virtual office expenses are recurring costs that buyers must factor into their annual budgets.

Hidden and Additional Expenses

Due Diligence and Legal Review

Thorough due diligence is essential before purchasing a shelf company. Buyers should engage legal professionals to review the company’s history, verify its compliance status, and confirm the absence of hidden liabilities. Legal review fees represent an upfront investment that can prevent costly mistakes later. Skipping this step increases the risk of acquiring a shelf corporation with undisclosed debts or legal issues.

Penalties, Late Fees, and Restoration Costs

Failure to meet compliance requirements, such as missing the annual renewal fee deadline, can result in penalties and late fees. In some jurisdictions, penalties escalate over time, and authorities may strike the company off the register. Restoration costs to reinstate a struck-off shelf company can range from $300 to $600 or more, depending on the jurisdiction. These additional expenses can significantly increase the total shelf companies cost.

Transfer, Rebranding, and Record Updates

After acquiring a shelf company, buyers often need to update company records, appoint new directors, or change the company name. These post-acquisition expenses include government filing fees, expedited name change services, and administrative charges for updating public records. Setting up new bank accounts and registering for taxes also incur costs. Customizing a shelf corporation to fit the new owner’s needs can add hundreds or even thousands of dollars to the initial purchase price.

- Hidden financial liabilities such as unpaid debts, loans, unpaid taxes, or legal issues that existed before acquisition.

- Higher purchase costs compared to incorporating a new company.

- Risks of scams including fabricated business histories, non-existent credit lines, or fraudulent schemes.

- Additional post-acquisition expenses for customizing the company, including changing company name, appointing new directors, updating business details.

- Costs related to setting up bank accounts and registering for taxes after acquisition.

Note: Always request written guarantees about the company’s history and liabilities before completing the purchase.

How Much Does a Shelf Corporation Cost by Age and Jurisdiction?

Newly Formed vs. Aged Shelf Companies

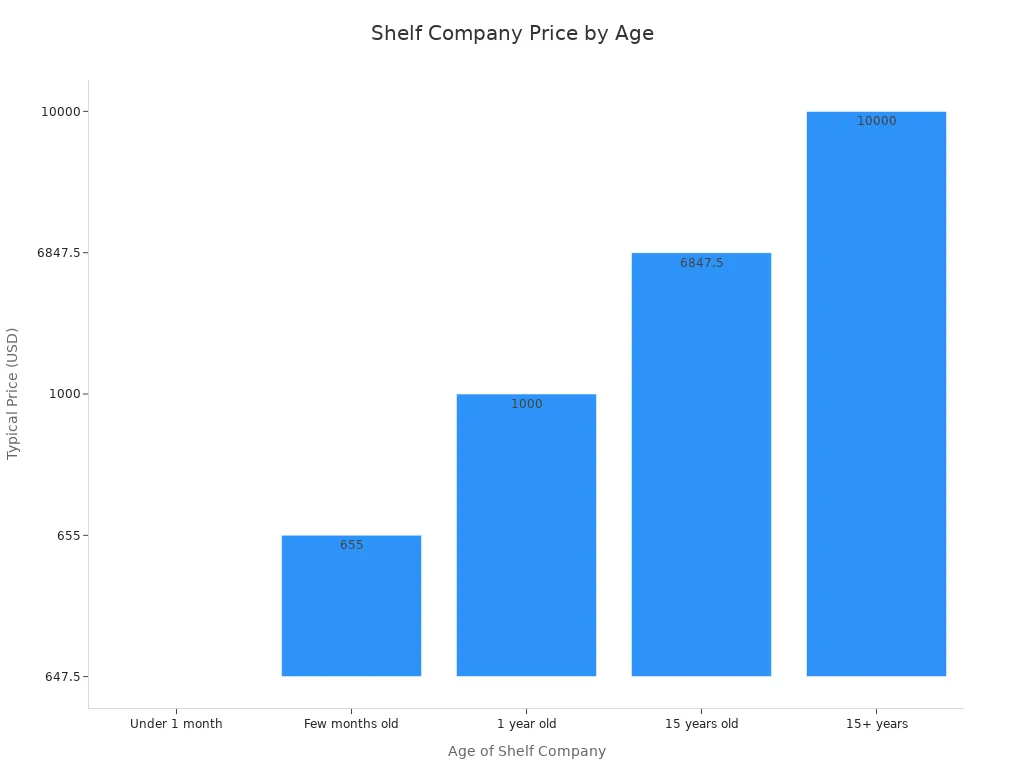

The cost of a shelf company depends heavily on its age. Newly formed shelf companies, often less than a month old, typically cost around $645 to $650. As the company ages, the price increases significantly. A shelf company that is one year old may cost about $1,000. Companies with a history of 15 years or more can reach prices between $6,695 and $10,000. This price jump reflects the perceived value of an established business history and the potential for improved credibility.

| Age of Shelf Company | Typical Price Range (USD) |

|---|---|

| Under 1 month (newly formed) | Around $645 – $650 |

| Few months old | Slightly above $650 |

| 1 year old | About $1,000 |

| 15 years old | $6,695 – $7,000 |

| Up to 15 years or older | Up to $10,000 |

Aged shelf corporations command higher prices because they offer a longer filing history and a more established reputation. Buyers seeking instant credibility or eligibility for contracts often prefer these older entities.

Domestic vs. Offshore Shelf Companies

Shelf company costs also vary based on jurisdiction. Domestic shelf companies, such as those registered in the United States, usually have transparent pricing and straightforward compliance requirements. Offshore shelf companies, registered in locations like Belize or Anguilla, may offer privacy benefits and tax advantages. However, offshore options often come with higher annual maintenance fees and additional due diligence requirements.

- Domestic shelf companies: Lower upfront costs, easier compliance, and faster transfer processes.

- Offshore shelf companies: Higher annual fees, complex regulations, and increased scrutiny from banks and regulators.

Buyers must weigh the benefits of each option against the total cost of ownership, including ongoing fees and legal compliance.

State-by-State and International Price Differences

The answer to how much does a shelf corporation cost depends on both the state or country of registration and the age of the entity. In the United States, states like Wyoming and Nevada offer some of the most affordable shelf company options, with prices starting near $650 for new companies. States with higher regulatory standards or greater business prestige, such as Delaware or California, may see prices rise for similar entities.

Internationally, shelf company prices can fluctuate even more. Jurisdictions with strong reputations for business stability or privacy, such as Switzerland or Singapore, often command premium prices. Offshore locations may offer lower purchase prices but require higher annual fees and more complex compliance.

Tip: Always compare the total cost, including purchase price, annual fees, and legal requirements, before selecting a shelf company in any jurisdiction.

Shelf Company vs. New Company: Cost and Time Comparison

Upfront Costs and Incorporation Fees

Business owners often compare the initial expenses of acquiring shelf companies with the costs of forming a new entity. Shelf companies typically require a higher upfront investment. Buyers pay not only for the legal transfer but also for the established history and administrative handling. These costs may include transfer fees, legal review, and updates to company records. New company formation involves government filing fees, registration charges, and sometimes legal assistance. However, these costs are usually lower than the purchase price of a shelf company.

| Expense Type | Shelf Company | New Company Formation |

|---|---|---|

| Purchase/Formation Fee | Higher (includes history) | Lower (basic registration) |

| Legal Review | Essential for due diligence | Optional |

| Transfer Fees | Common | Not applicable |

| Record Updates | Often required | Part of initial setup |

| Customization | Limited | Full control |

Shelf companies offer immediate ownership, which can justify the higher initial expense for those who need to start operations quickly. New companies provide greater flexibility in naming, structure, and objectives, but require more time to build credibility.

Time to Operational Readiness

Speed remains a major advantage for shelf companies. Buyers can acquire a pre-registered entity and begin operations almost immediately. Locally, the purchase process may take only a few hours. Remote transactions can extend the timeline to about two weeks. In contrast, forming a new company involves a lengthy registration process. Owners must wait several months to a year to complete all steps, including obtaining permits and meeting compliance requirements.

- Shelf companies allow business operations within hours after purchase.

- Remote acquisition may require up to two weeks.

- Ownership transfer, such as processing certificates in some countries, can take two to three months.

- Changing the company name or purpose may take up to a year due to regulatory filings.

- New company formation demands several months to a year before reaching operational status.

| Aspect | Shelf Company | New Company Formation |

|---|---|---|

| Operational readiness | Almost immediate (pre-registered) | Several months to a year |

| Ownership transfer process | 2-3 months (if required) | Not applicable |

| Name or purpose change | Up to a year (amendments) | Part of initial setup |

| Purchase time (local/remote) | Hours locally; two weeks remotely | Not applicable |

| Advantages | Fastest route to operations | Full customization |

Shelf companies provide a shortcut to operational readiness, saving significant time and effort. New companies require patience and careful planning before launching business activities.

Long-Term Expenses and Potential Savings

Long-term costs and savings depend on the choice between shelf companies and new company formation. Shelf companies save time and expense by avoiding the lengthy formation process. They grant instant access to contract bidding and government opportunities that require a minimum company age. The established history can enhance credibility with clients, suppliers, and investors. Shelf companies may also facilitate easier access to banking relationships and credit lines.

However, buyers must remain cautious. Acquiring a shelf company with prior business history can transfer liabilities, debts, or lawsuits to the new owner. Thorough investigation and due diligence are essential to avoid hidden costs. Shelf companies often involve higher ongoing fees, such as annual renewals, registered agent charges, and administrative expenses. New companies offer more flexibility and lower initial costs, but owners must invest time to build reputation and access opportunities.

- Shelf companies save time and effort, allowing immediate business operations.

- They provide instant credibility and access to opportunities restricted to established entities.

- New companies offer greater flexibility but require time to build trust and reputation.

- Shelf companies may involve higher ongoing fees and risk of inheriting liabilities.

- Careful evaluation of business needs helps determine the best option for long-term savings.

Tip: Always purchase shelf companies from reputable sources and conduct thorough due diligence to avoid hidden liabilities and unexpected expenses.

Risks and Legal Considerations of Shelf Companies

Hidden Liabilities and Credit Issues

Shelf corporations can expose buyers to significant hidden liabilities. These risks often remain concealed until after the purchase. Common issues include:

- Undisclosed debts or unresolved tax obligations

- Pending lawsuits or contingent liabilities

- Financial misrepresentations, such as inflated asset values

- Incomplete or obscured corporate records

Buyers may also encounter fraudulent credit acquisition schemes. In these cases, sellers misrepresent shelf corporations as having established creditworthiness. This practice can result in unpaid obligations and legal disputes. The use of nominee directors and opaque ownership structures further complicates risk assessment. Scam operators sometimes forge or omit documentation to hide these liabilities. Fast transaction pressure and prices below market value often signal hidden financial risks. When a shelf corporation carries a history of illegal acts or damages, the new owner inherits these problems. This lack of asset protection can lead to unexpected financial burdens and reputational damage.

Compliance and Regulatory Risks

Purchasing shelf corporations introduces immediate compliance responsibilities. Buyers must update statutory registers and fulfill all filing requirements. Shelf corporations may carry hidden liabilities, such as unpaid penalties or outdated filings, even if dormant. Non-compliance risks include:

- Failure to update statutory records or notify authorities

- Penalties for late filings or outdated information

- Criminal offenses for non-compliance with reporting obligations

Anti-money laundering regulations require verification of client identity and reporting of suspicious transactions. Advisers and agents must ensure compliance to prevent financial crime. Buyers must also verify dormant accounts and director history. Ethical risks arise if shelf corporations are used to mislead others about company age or ownership. The new owner becomes responsible for any outstanding penalties or liabilities incurred before purchase. Failure to comply with tax and regulatory obligations, such as corporation tax or VAT, can result in fines or criminal charges.

| Jurisdiction | Taxation/Reporting Requirements | Additional Costs |

|---|---|---|

| BVI | No income/capital gains tax; registration mandatory | State license, due diligence, director registration |

| Delaware/Nevada | Varying tax advantages; strict reporting and compliance required | Annual fees, compliance costs |

| Offshore (Cayman) | Low/zero corporate tax; strict AML/KYC rules | Licensing, reporting, transparency requirements |

Note: Professional tax advisors should be consulted to understand specific tax consequences in each jurisdiction.

Reputation and Suitability for Business Goals

The reputation of shelf corporations plays a critical role in achieving business objectives. A reputable shelf corporation provides immediate credibility and gives the impression of longevity and stability. This positive image can:

- Enhance client confidence and trust

- Facilitate easier access to financing, such as credit lines and loans

- Help secure contracts and build relationships with suppliers

A shelf corporation with no past liabilities, no operational activities, and proper legal compliance maintains a strong reputation. Enhanced borrowing power and established banking relationships support smoother financial management. However, if a shelf corporation has a history of unresolved issues or non-compliance, its reputation suffers. This damage can hinder contract opportunities and limit access to financial resources. The suitability of shelf corporations depends on their ability to accelerate trust-building, financing, and market acceptance.

Is a Shelf Company Worth the Cost?

When Shelf Companies Make Sense

Shelf companies offer distinct advantages in specific scenarios. Business owners often seek aged entities to establish a business history quickly. They enhance corporate image by leveraging the perceived credibility of company age. Many lenders and partners prefer working with established companies, which can encourage business relationships. Shelf companies help meet minimum age requirements for bidding on contracts and facilitate bank loans by showing a longer incorporation history. Some corporate credit cards and leases require a company to be a certain age.

- Establishing a business history rapidly

- Enhancing credibility for contract bids

- Building corporate credit more easily

- Meeting age requirements for government tenders

- Facilitating access to bank loans and credit cards

In today’s regulatory environment, authorities and financial institutions prioritize substance, transparency, and compliance over mere company age. Shelf companies may still provide advantages for government tenders or banking products with age thresholds. However, buyers must supply full documentation of company activities and ownership. The shelf company’s value depends on its ability to meet these narrow requirements without exposing the buyer to unnecessary risk.

When to Avoid Shelf Companies

Not every situation justifies the purchase of a shelf company. Buyers should avoid entities that have been dissolved and reinstated, as lenders often treat them as new companies. Legal complications, hidden liabilities, and fraud risks such as company hijacking or credit manipulation pose significant threats. Shelf companies with existing EINs require proper transfer documentation, or buyers risk inheriting tax issues. Offshore shelf companies or those with suspicious ownership changes demand extra caution.

- Companies with a history of dissolution or reinstatement

- Entities with unclear legal standing or hidden liabilities

- Shelf companies used to manipulate credit or secure loans illegally

- Offshore companies with questionable ownership or recent leadership changes

- Providers who cannot verify the company’s clean history

Shelf companies can be expensive and may not suit startups or small businesses. Lenders may restrict access to credit if fraud is suspected. Using shelf companies to obtain loans or credit for which the buyer is not eligible can lead to lawsuits and financial penalties. Experts warn that buying shelf companies with aged tradelines to manipulate credit reporting is often illegal. Buyers must perform thorough due diligence and use reputable providers to reduce risks.

Practical Tips for Evaluating Shelf Companies

Buyers should follow a structured approach to evaluate shelf companies before purchase. Conducting thorough due diligence is essential. Financial audits, legal checks, and contract reviews help verify accuracy and identify risks. Analyzing financial statements and liabilities ensures no hidden debts exist. Reviewing the purchase agreement clarifies the company’s identity, assets, and transfer conditions.

- Conduct financial audits and legal checks.

- Analyze financial statements for hidden debts.

- Review the purchase agreement for clarity.

- Verify legal registration and documentation.

- Complete ownership transfer with notarized documents.

- Assess company value using commercial appraisal methods.

- Confirm active clients and contracts.

- Evaluate financing options and potential profitability.

Key factors include understanding the company’s intentions, reviewing timing and method of securities sales, and assessing reputation. Buyers should examine the types of securities offered and their impact on shareholder value. Checking financial health and eligibility requirements for shelf offerings is critical. Flexibility in raising capital and potential downsides such as dilution risk must be considered. Reviewing official registration statements and prospectus supplements provides insight into the offering’s specifics.

Tip: Buyers who follow these steps and consult professional advisors can minimize risks and make informed decisions about whether a shelf company aligns with their business goals.

Understanding the true cost of shelf companies means considering not only the purchase price but also ongoing fees and hidden expenses. Due diligence remains essential. Buyers should:

- Verify company registration, good standing, and historical ownership.

- Examine financial records, tax compliance, and potential liabilities.

- Confirm the absence of prior business activities or hidden contracts.

- Assess the legitimacy of ownership and review directors’ backgrounds.

A shelf company suits those who need instant credibility or must meet strict age requirements. However, buyers should always compare shelf companies with new company options before making a decision.

FAQ

What is the main advantage of buying a shelf company?

A shelf company allows buyers to start business operations immediately. The company already exists and has an established history, which can help with credibility and contract eligibility.

Are shelf companies legal in the United States?

Shelf companies remain legal in the United States. Buyers must ensure compliance with all federal and state regulations. Legal risks arise only if someone uses the company for fraudulent or deceptive purposes.

Can a shelf company guarantee business credit approval?

No shelf company can guarantee business credit approval. Lenders evaluate many factors, including financial statements, business plans, and owner backgrounds. Company age alone does not secure credit.

How long does it take to transfer ownership of a shelf company?

Ownership transfer usually takes a few hours to a few days for domestic companies. Offshore or international transfers may require up to two weeks, depending on jurisdiction and documentation.

What hidden costs should buyers expect with shelf companies?

Buyers should expect legal review fees, annual renewal charges, registered agent fees, and possible penalties for late filings. Additional costs may include rebranding, updating records, and restoring companies struck off the register.

Do shelf companies come with existing tax liabilities?

Some shelf companies may carry unpaid taxes or unresolved financial obligations. Buyers should always conduct thorough due diligence and request written confirmation of a clean financial history.

Is it possible to change the name of a shelf company after purchase?

Yes, buyers can change the name of a shelf company. The process involves filing paperwork with the relevant authorities and paying administrative fees. Name changes may take several days to complete.

Who should avoid purchasing a shelf company?

Startups, small businesses, and anyone seeking full control over company structure should avoid shelf companies. Those unable to perform proper due diligence or who do not need immediate operational readiness may find new company formation more suitable.