Projections for Vusiongroup stock show a powerful growth trajectory through 2026. The company’s innovative products, including Electronic Shelf Labels, the ESL Gateway AP, and the ESL Price Tag, drive its success in the Esl Retail market. The vusion group stock forecast highlights significant expansion. Analysts predict powerful annual earnings growth. The vusiongroup stock outlook is supported by these key metrics:

- Annual Earnings Growth: A 58.3% forecast signals robust earnings potential.

- Annual Revenue Growth: Top-line revenue is expected to climb 19%.

- Earnings Per Share Growth (EPS): A remarkable 75.3% annual EPS growth is anticipated.

- Future Return on Equity: A high future return on equity of 36% indicates efficient profit generation.

Core 2026 Financial Projections and Future Growth

The financial projections for VusionGroup paint a picture of exceptional expansion through 2026. These figures are not just numbers; they represent a clear strategy for market leadership and shareholder value. The vusiongroup stock forecast is built on a foundation of aggressive yet achievable targets. Let’s break down what these core metrics mean for the company’s future growth.

Decoding the Earnings and Revenue Growth Forecast

Understanding the top-line and bottom-line projections is crucial for evaluating the vusiongroup stock. The company’s strategy focuses on converting strong sales into even stronger profits.

The 58.3% Annual Earnings Growth Figure

A projected 58.3% annual earnings growth rate is the headline figure for a reason. This number indicates that VusionGroup’s profitability is expected to compound at an extraordinary pace. This level of growth suggests the company is effectively managing its costs while scaling its operations. Analysts see this as a clear signal of high growth earnings potential. The forecast points toward a significant expansion in net income, which directly impacts the company’s valuation and its ability to reinvest in innovation. This powerful earnings growth is a cornerstone of the investment thesis for vusiongroup stock.

The 19% Annual Revenue Growth Rate

The projected 19% annual revenue growth rate demonstrates sustained, robust demand for VusionGroup’s solutions. This figure significantly outpaces many competitors and the broader market. This high growth revenue is driven by the increasing adoption of digital solutions in retail. The company is successfully expanding its customer base and deepening relationships with existing partners. This consistent increase in revenue provides the fuel for the company’s impressive earnings forecast.

Profitability Metrics Deep Dive

Profitability metrics reveal how efficiently a company turns revenue into actual profit. For VusionGroup, the outlook is exceptionally strong, highlighting a business model that excels at creating value.

75.3% Annual EPS Growth Trajectory

Earnings Per Share (EPS) is a critical metric for investors. The forecast for a 75.3% annual EPS growth is remarkable. It shows that the company’s earnings are growing much faster than its share count. This massive expansion in EPS directly translates to greater value for each share of stock. Such a high EPS growth trajectory makes the vusion group stock very attractive to growth-oriented investors. The powerful earnings growth directly enhances the EPS figure.

Note: A high EPS growth forecast often signals strong management efficiency and a profitable business model. It indicates that the company’s earnings are not just growing, but they are creating substantial value on a per-share basis.

Future Return on Equity (ROE) of 36%

The future Return on Equity (ROE) of 36% is another standout metric. ROE measures how effectively management uses shareholder investments to generate earnings. A forecast of 36% is considered excellent and places VusionGroup in the top tier of its industry. This high future return on equity signifies that the company is not just growing, but it is doing so very efficiently. This strong return on equity reinforces the quality of the company’s earnings and its potential for long-term, sustainable growth.

Examining the Vusiongroup Stock Forecast

The individual metrics combine to form a compelling stock forecast. The path to 2026 appears well-defined, supported by strong commercial drivers and a clear strategy.

Path to Profitability in 2026

VusionGroup’s path to enhanced profitability is clear. The strategy involves leveraging its technology to capture more market share. The strong revenue growth provides the foundation. The company then uses its operational leverage to ensure that a large portion of that new revenue flows down to become earnings. This combination is the engine behind the impressive earnings and EPS growth.

| Metric | 2026 Forecast | Implication for VusionGroup |

|---|---|---|

| Annual Earnings Growth | 58.3% | Rapidly expanding profitability |

| Annual Revenue Growth | 19% | Strong market demand and sales execution |

| Annual EPS Growth | 75.3% | Increasing value for shareholders |

| Future Return on Equity | 36% | Highly efficient use of capital |

Long-Term Commercial Momentum

The financial forecast is not based on short-term trends. It reflects long-term commercial momentum. VusionGroup is a leader in the digital transformation of retail, a multi-year global trend. The company’s strategic partnerships and technological edge provide a durable competitive advantage. This momentum is expected to sustain the company’s future growth, supporting the vusion group stock and its journey toward the 2026 targets. The outlook for earnings remains positive due to this momentum.

Vusion Group’s Market Position and Competitive Edge

VusionGroup’s impressive financial forecasts are rooted in a dominant market position and a clear competitive advantage. The company consistently demonstrates superior performance against both its local market and the broader electronics industry. This strong standing supports the positive outlook for the vusiongroup stock and its potential for future growth.

Outperforming the French Market

VusionGroup sets itself apart by significantly outpacing its domestic market’s benchmarks. This outperformance is a key indicator of its operational strength and market leadership.

Vusion’s Revenue Growth vs. Market Average

The company’s revenue growth story is compelling. In 2024, VusionGroup’s adjusted sales hit €1,010.5 million, a 25% increase from the previous year. This level of expansion far exceeds the average market growth in France, showcasing its ability to capture a larger share of the market. This robust revenue performance provides a solid foundation for its earnings.

Vusion’s Earnings Growth vs. Market Average

Strong revenue directly translates into exceptional earnings growth. VusionGroup’s ability to scale its operations efficiently allows it to convert sales into profits at a rate that surpasses the French market average. This superior earnings performance is a testament to its effective business model and a core reason for its optimistic financial projections.

Benchmarking Against the Electronic Equipment Industry

When compared to the global electronic equipment industry, VusionGroup’s metrics are equally impressive. The company is not just a local leader but a global contender.

Industry Revenue Growth Comparison

VusionGroup has confirmed ambitious growth objectives for 2025, projecting an increase of approximately 40% over 2024. The company aims to reach €1.4 billion in adjusted annual revenue. This aggressive growth target places it at the forefront of the industry, signaling strong and sustained demand for its solutions.

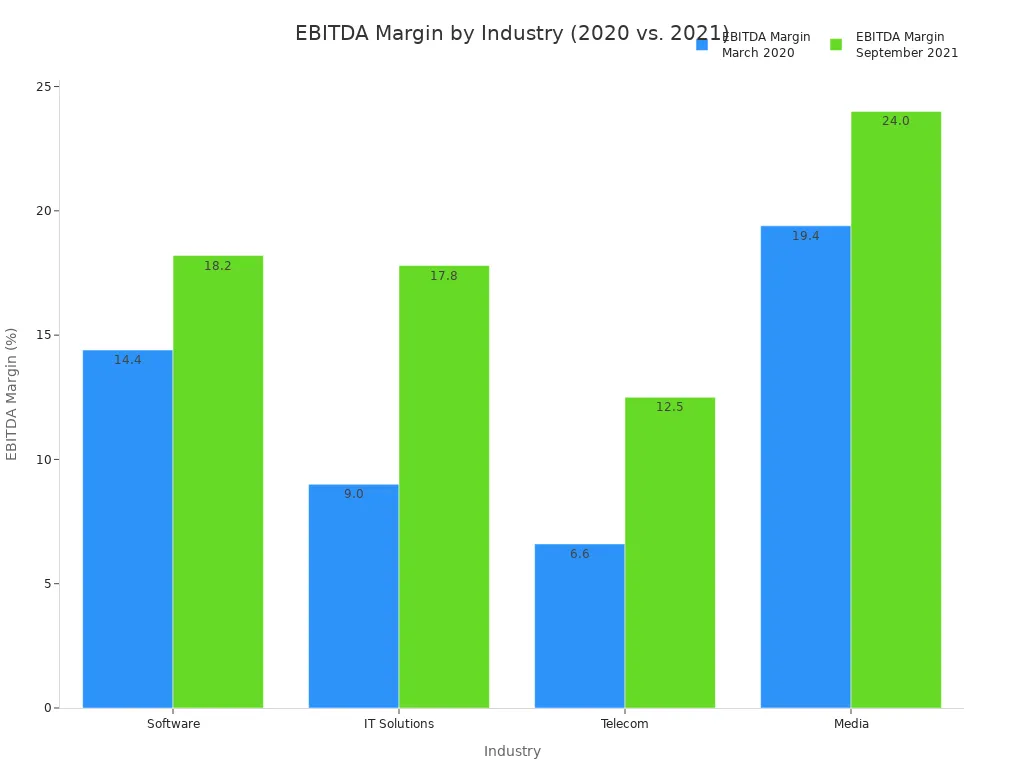

Industry Profitability Norms

The electronic component sector is known for being capital-intensive yet high-margin. VusionGroup excels in this environment. Its profitability outlook surpasses typical industry norms, reinforcing the quality of its earnings.

| Component/Metric | Typical/Forecasted Margin |

|---|---|

| RF Transceivers | 46.7% Gross Margin |

| Microcontroller Units (MCUs) | 40% Gross Margin |

| VusionGroup (2026 Forecast) | 79% EBITDA Margin |

This high forecasted margin highlights an extremely efficient model for generating earnings.

Vusion’s Unique Selling Proposition

The company’s success is built on tangible technological advantages and strategic relationships that create a powerful competitive moat.

Electronic Shelf Label (ESL) Technology Leadership

VusionGroup’s leadership stems from its innovative ESL technology. Its solutions offer more than just digital price tags; they are a platform for retail transformation. Key advantages include:

- Real-time updates and AI integration to optimize pricing and stock levels.

- Advanced E-Ink displays with high resolution and very low power needs.

- Interactive features like NFC and QR codes that create an omnichannel experience.

- Seamless integration with existing retail IoT ecosystems for maximum compatibility.

Strategic Global Retail Partnerships

This technological edge makes VusionGroup a preferred partner for leading global retailers. These strategic partnerships secure long-term contracts, providing predictable revenue streams and solidifying the company’s market position. This stability is a crucial factor supporting the vusiongroup stock and its projected earnings.

Analyst Sentiment and Vusion Group Stock Valuation

Wall Street’s view on the vusiongroup stock provides a critical layer of analysis for any potential investor. The sentiment, derived from detailed financial modeling and industry expertise, helps shape market expectations. A thorough analysis of analyst ratings, price targets, and technical charts offers a roadmap for the stock’s potential journey toward 2026. These professional predictions are essential for understanding the future earnings potential.

Wall Street’s Consensus on Vusion Group Stock

The collective opinion of financial analysts points toward a strong belief in VusionGroup’s growth story. This consensus is built from individual assessments of the company’s fundamentals, market position, and future earnings outlook.

Conflicting Analyst Ratings Explained

The world of stock analysis rarely presents a unanimous view. While some variance exists in ratings for the vusiongroup stock, the overwhelming sentiment is positive. An analysis of 17 covering analysts reveals a ‘Buy % Consensus’ of 88%. This indicates that the vast majority of experts recommend purchasing the stock. Any conflicting or neutral ratings often stem from different assumptions about execution risks or macroeconomic headwinds. An investor should view this high consensus as a strong vote of confidence in the company’s strategy and its ability to deliver on its powerful earnings forecast.

Breakdown of Price Targets: €283.10 Average

The average price target for Vusion Group stock stands at an impressive €283.10. This figure represents the mean of all price predictions from covering analysts. It serves as a key benchmark for where the market expects the price to head over the next 12 to 18 months. This average target is significantly above the current price, suggesting substantial upside potential. The target is derived from a detailed analysis of the company’s growth trajectory and profitability metrics.

Recent Analyst Actions and Price Target Analysis

Recent analyst updates provide a more current snapshot of sentiment. These actions often follow major company announcements or earnings reports, reflecting the latest available information. The price target increased by one analyst is a strong signal. Another analyst saw the price target increased as well.

Key Takeaway: An analyst often revises a price target upward when a company exceeds earnings expectations or demonstrates stronger-than-anticipated market momentum. A price target increased is a bullish indicator.

High Estimate of €305 and Low of €251

The range of analyst price targets reveals the spectrum of expectations. The high-end target of €305 suggests one analyst sees a best-case scenario unfolding, where VusionGroup executes its strategy flawlessly. The low-end target of €251, while more conservative, still represents significant upside. This range helps an investor understand the potential risk and reward. The fact that even the lowest price target is optimistic underscores the positive outlook. The price target increased by a firm shows confidence. A price target increased is a positive sign.

Understanding Recent Downgrades and Upgrades

Recent analyst actions have been predominantly positive, reinforcing the buy consensus. Upgrades and maintained ‘Buy’ ratings signal continued confidence. For example, both Portzamparc and Oddo Bhf have recently reiterated their positive stance. A price target increased by an analyst is a key event. The price target increased reflects new, positive data. The price target increased is what investors look for. When a price target increased, it often moves the stock price.

| Date | Firm | Action | Rating |

|---|---|---|---|

| 2025-09-16 | PORTZAMPARC BNP PARIBAS | Maintains | Buy |

| 2025-09-16 | Oddo Bhf | Maintains | Buy |

These actions show that key firms tracking the vusion group stock continue to support the growth narrative. The analyst future growth forecasts remain strong. The price target increased by these firms supports the bullish thesis.

Reading the Technical Charts for 2026

Technical analysis offers a different lens for viewing the vusion group stock. It focuses on price patterns and trading volumes to forecast future price movements. This analysis complements the fundamental view provided by analysts.

Key Moving Average Signals

Moving averages help smooth out price data to identify the direction of the trend. For Vusion Group, key signals would involve the 50-day moving average crossing above the 200-day moving average, a pattern known as a “golden cross” that indicates bullish momentum. Furthermore, technical chart analysis identified a crucial support level of €202. This price level acted as a floor for the stock, indicating strong buying interest. This support is a foundational element for future price growth toward the 2026 target.

Volume and Momentum Indicators

Volume and momentum indicators provide insight into the strength behind price movements.

- High Trading Volume: An increasing price accompanied by high trading volume suggests strong conviction among buyers. It validates the upward trend.

- Momentum Oscillators (like RSI): These tools help an investor gauge if a stock is overbought or oversold. For Vusion Group, a healthy momentum reading would show the stock is in a sustainable uptrend, not an overheated rally. This technical analysis is crucial for timing entry and exit points.

Risks and Headwinds for the 2026 Outlook

An investor must weigh the impressive growth forecasts for VusionGroup against potential risks. A balanced view considers macroeconomic pressures, company-specific hurdles, and the challenges of sustaining rapid expansion. Understanding these headwinds is crucial for a comprehensive analysis of the 2026 outlook.

Macro-Economic Factors to Monitor

Global economic conditions create a complex backdrop for any company. VusionGroup’s performance will be influenced by broad trends in inflation, interest rates, and consumer behavior.

Inflation and Interest Rate Impact

Central banks in major economies are maintaining a ‘higher for longer‘ stance on interest rates to manage inflation. This environment presents a dual challenge. Rising rates can increase the cost of debt financing and put pressure on company valuations, particularly in the technology sector. However, Technology, Media, and Telecommunications (TMT) firms like VusionGroup are often seen as resilient due to their growth potential. These companies are accustomed to adapting to disruptive scenarios through strategic financial management and by adjusting their value propositions. The durability of cash flow becomes paramount in this climate.

Global Consumer Spending Trends

Retail health directly impacts demand for VusionGroup’s solutions. Current trends show surprising resilience, especially among younger consumers.

- Younger Generations Drive Spending: Gen Z and millennials are expected to power consumer spending through 2025, showing a greater willingness to take on debt for near-term purchases.

- In-Store Shopping Preference: These same digital-native generations are increasingly shopping in physical stores. About 59% of Gen Z favor shopping malls, reinforcing the need for retailers to invest in the in-store experience.

- Sustainability Matters: Younger shoppers often base purchasing decisions on sustainability, creating an opportunity for retailers using VusionGroup’s ESLs to communicate eco-friendly product attributes effectively.

Company-Specific Challenges and Execution Risks

Beyond the macro environment, VusionGroup faces internal challenges related to its supply chain and competitive positioning.

Supply Chain Vulnerabilities

As a hardware-centric technology company, VusionGroup depends on a complex global supply chain for components like microcontrollers and E-Ink displays. Any disruption, whether from geopolitical tensions, trade disputes, or natural disasters, could lead to production delays and increased costs. Managing these vulnerabilities is essential for meeting customer demand and protecting profit margins.

Sustaining a Competitive Advantage

VusionGroup is a leader in the ESL market, but the technology sector is characterized by rapid innovation. Competitors will continuously work to close the technology gap. The company must maintain its pace of research and development to keep its solutions at the forefront of the industry. Failure to innovate could erode its market share and pricing power over the long term.

Execution and Sustainability of Growth

The company’s ambitious forecasts depend entirely on its ability to execute its strategy and scale its operations effectively.

Scaling Operations Effectively

Rapid growth puts immense strain on a company’s operations, logistics, and support teams. VusionGroup must expand its capacity to manufacture, deliver, and install its solutions across thousands of stores globally without sacrificing quality or customer satisfaction. Successfully managing this expansion is a key execution risk tied to its 2026 targets.

VusionCloud Software Platform Adoption Rate

The long-term value proposition for VusionGroup is increasingly tied to its software and data solutions, particularly the VusionCloud platform. The adoption rate of this platform is a critical metric. The company’s expanded agreement with Walmart to accelerate the deployment of VusionCloud and EdgeSense across thousands of U.S. stores is a powerful indicator of positive momentum. This successful rollout, which began with an initial 500 stores and is planned for an additional 2,300, demonstrates strong customer buy-in and is vital for future recurring revenue growth.

The 2026 outlook for the vusiongroup stock is defined by a powerful growth forecast. The company projects 58.3% annual earnings growth and 19% revenue growth. Strong fundamentals support this forecast, including a 75.3% EPS forecast and a 36% future return on equity. An investor should note the positive analyst sentiment; a price target increased by one firm reinforces the high average price target. Another price target increased shows confidence. While risks exist, the long-term narrative for the vusion group stock remains compelling. The vusiongroup stock price target, EPS, and earnings outlook present a notable opportunity for an investor. The analyst price target increased is a key signal for the stock’s price potential.

FAQ

What is VusionGroup’s primary business?

VusionGroup is a technology leader in the retail sector. The company specializes in digital solutions like Electronic Shelf Labels (ESLs) and cloud-based software platforms. These products help retailers optimize pricing, manage inventory, and enhance the in-store customer experience.

What is the 2026 earnings growth forecast for VusionGroup?

Analysts project powerful annual earnings growth of 58.3% for VusionGroup through 2026. This forecast indicates a rapid expansion of the company’s profitability. It suggests effective cost management and successful scaling of its business operations.

What is the average analyst price target for the stock?

The average analyst price target for VusionGroup stock is €283.10. This consensus figure suggests significant upside potential from its current price. The target reflects strong confidence in the company’s future growth and earnings potential.

Why is the 75.3% EPS growth forecast significant?

A 75.3% annual Earnings Per Share (EPS) growth forecast is remarkable. It shows earnings are growing much faster than the number of shares. This trend creates substantial value for each share, making the stock highly attractive to growth-focused investors.

What are the main risks to VusionGroup’s outlook?

Key risks include macroeconomic factors like inflation and interest rates. Company-specific challenges involve potential supply chain disruptions for electronic components. The company must also sustain its competitive advantage through continuous innovation to meet its ambitious growth targets.

How does VusionGroup outperform its market?

VusionGroup’s revenue growth significantly exceeds the French market average. Its projected 25% sales increase in 2024 showcases its ability to capture market share. This superior performance provides a solid foundation for its exceptional earnings growth forecasts.

What is VusionCloud?

VusionCloud is the company’s software platform. It is a key part of its long-term strategy. The platform allows retailers to manage ESLs and gather data. High adoption rates, like the expanded Walmart agreement, are crucial for future recurring revenue.

See Also

Page Not Found: Navigating The Digital Abyss Of Missing Content