The grocery retail industry is rapidly evolving with Grocery Retail Trends 2025 shaping the landscape. Companies are opening more stores, increasing investments, and attracting more shoppers each year.

Aspect | Statistic / Trend | Year / Period |

|---|---|---|

Grocery store foot traffic | Nearly 17.2 billion visits; a 1.0% increase compared to 2023 | 2024 |

Aldi store expansion | Plans to open 225 new stores | 2025 |

Retail media ad spending | $52 billion; a 20.4% rise from 2023 | 2024 |

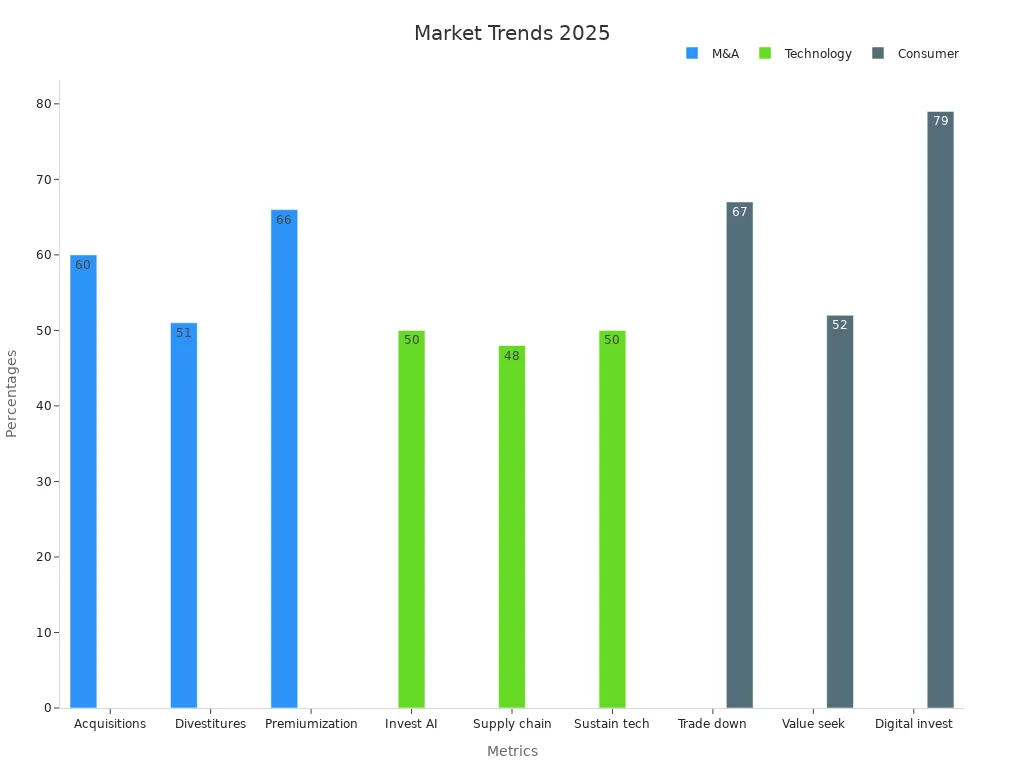

Mergers, sustainability initiatives, and advanced technology are key drivers helping companies stay competitive and meet evolving customer demands. Significant investments are being made in AI, supply chain tracking, and energy-efficient systems.

Digital transformation plays a crucial role in these Grocery Retail Trends 2025. Solutions like panpantech’s Electronic Shelf Labels enable stores to update prices quickly, reduce energy consumption, and enhance shopper engagement. Grocery retailers adopting these innovative tools are well-positioned to lead in this fast-changing market.

Key Takeaways

Grocery stores are getting bigger by opening new stores. They use smart technology like electronic shelf labels. This helps them change prices fast and waste less food.

Mergers and partnerships help grocery companies grow. These deals make supply chains better. This helps stores serve customers well.

Private label products are becoming more popular. They are good quality and cost less. This makes big brand names face more competition.

Shoppers want healthier foods and bold flavors from other countries. They also want more plant-based protein choices. This changes what stores sell.

Sustainability is more important now. Stores support eco-friendly farming. They use controlled-environment farming to help the planet.

Grocery Retail Trends 2025

M&A Activity

Grocery retail trends for 2025 show more mergers and acquisitions. Companies do this to get bigger and reach more people. The grocery retail sector had 5% more deals and 46% more deal value from 2023 to 2025. This is important because other retail stores had fewer deals. Some big deals happened. ALDI bought about 400 stores from Southeastern Grocers. Carrefour bought 175 stores in France. Sainsbury’s turned 10 Homebase stores into supermarkets. These actions help companies get more customers and become stronger in the market.

Metric / Transaction | Grocery Retail Segment | Overall Retail Industry | Details / Impact |

|---|---|---|---|

Deal Volume Change (2023 Q1-Q3 YoY) | +5% | -14% | Grocery retail shows growth in deal volume while overall retail declines |

Deal Value Change (2023 Q1-Q3 YoY) | +46% | +12% | Grocery retail deal value rises substantially, indicating larger or more valuable deals |

ALDI Acquisition | ~400 stores from Southeastern Grocers | N/A | Expands ALDI’s US footprint significantly, with store conversions starting mid-2024 |

Carrefour Acquisition | 175 stores (60 Cora hypermarkets + 115 Match supermarkets) | N/A | €1.05 billion deal increases Carrefour’s French market share by 2.4%, with integration plans underway |

Sainsbury’s Acquisition | 10 locations from Homebase | N/A | £130 million deal to convert stores into supermarkets, expanding customer reach by 400,000 people |

These mergers help companies grow and get stronger in the market.

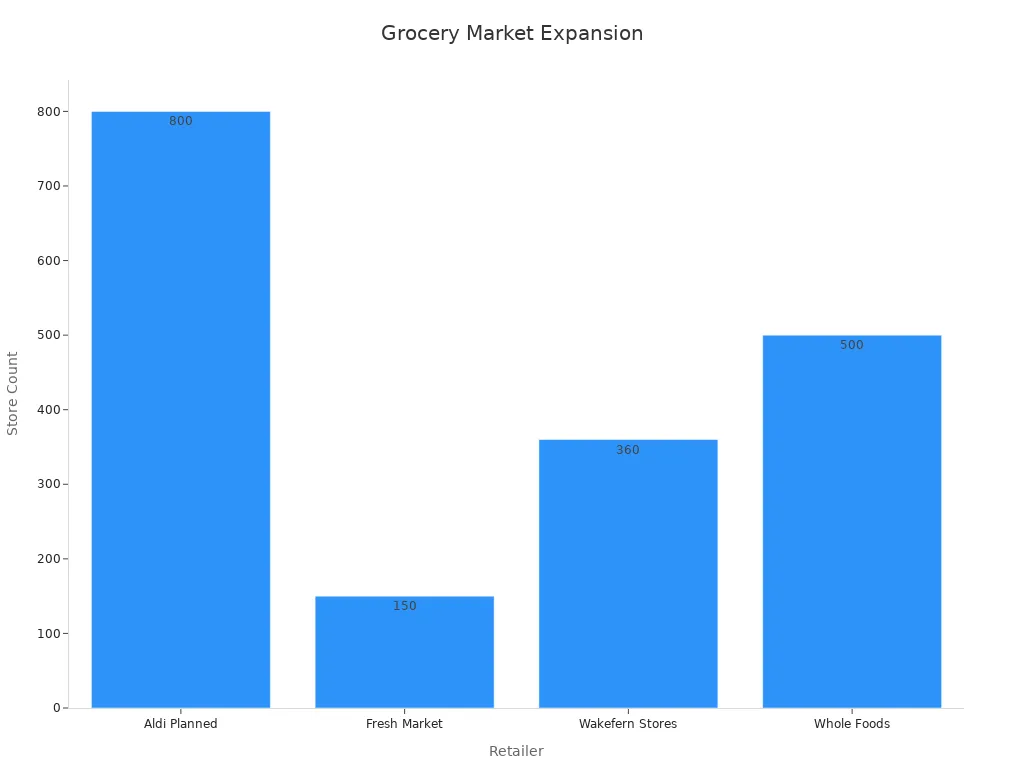

Market Expansion

Grocery retail trends for 2025 show fast market growth. Companies are opening more stores and going to new places. They want to reach more shoppers. The United States now has over 305,000 grocery stores. ALDI wants to open 800 stores by 2028. They have $9 billion for this plan. Other supermarkets like Wakefern Food Corporation, Whole Foods Market, and The Fresh Market are also adding more stores. Online grocery sales hit $104.4 billion in 2024, which is 9% more than last year. The online market grew by 17.7% in the second half of 2024. This means both regular and online supermarkets are getting a bigger part of the market.

Supermarkets use these plans to get more customers and grow their market share.

Integration Strategies

Integration strategies are very important for grocery retail trends in 2025. After a merger, companies try to work better together. They want to save money and make supply chains better. They also want to keep customers happy. For example, Kraft and Heinz joined to save money and sell more worldwide. Amazon bought Whole Foods to use e-commerce for better delivery and service. Supermarkets set goals to make more money and keep customers coming back. They check if customers are happy and if they are growing in the market. Good integration helps supermarkets stay strong and grow in a tough market.

Companies try to save money and improve supply chains.

They use customer experience scores to see if people are loyal.

They want to grow for a long time and work well with suppliers.

Training workers and managing risks are also important.

Grocery retail trends for 2025 show that good integration helps supermarkets grow and stay ahead.

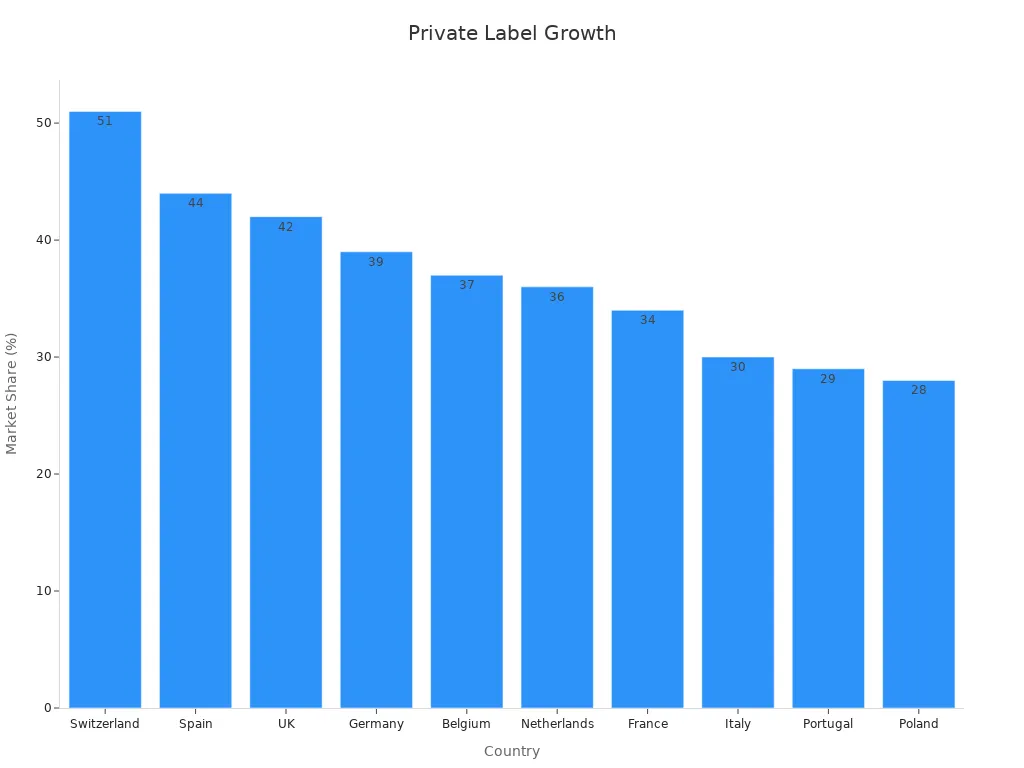

Private Label Growth

Private label products are changing how people shop for groceries. These store brands now make up a big part of what people buy. In the United States, private labels make up about 21.7% of money spent and 23.9% of items sold in early 2025. The private label market could grow from $145.63 billion in 2024 to $283.36 billion by 2030. Dairy products have the biggest share at 25%. Private labels are also growing each year in refrigerated foods, general foods, and drinks. Some over-the-counter medicines have private label shares as high as 50% in some stores.

More than 95% of shoppers buy private label products sometimes. Stores like Aldi and Trader Joe’s have private label sales of 80% and 69%. Costco, Sam’s Club, H-E-B, and Walmart all sell over 25% private label products.

Food Dupes

Food dupes are private label items that look and taste like famous brands. Many shoppers cannot tell them apart. In tests, 72% of people could not tell the difference between private label and national brand products. Almost half of shoppers tried private labels because they were copies of name-brand items. About 44% of shoppers, and 70% of people who earn a lot, are more likely to try private labels if they are sold as copies of expensive products. This trend helps private labels get loyal customers and grow.

Brand Competition

Private labels now go head-to-head with regular brands. They cost less, but many also focus on good quality and new flavors. The table below shows how private labels challenge national brands:

Metric | Evidence | Effect on Traditional Brands |

|---|---|---|

Private Label Market Share | 19.4% worldwide, 26% in Western Europe, up to 36% in some places | Regular brands lose their top spot |

Shopper Cost-Saving Behavior | 27% switch to private labels to save money | Brands lose shoppers to private labels |

Pricing Differential | Private labels are 10-20% cheaper | Brands feel pressure to lower prices |

Sales Growth | Private label sales grow 2.5% each year, others only 1% | Private labels grow faster than regular brands |

Stores give more shelf space to private labels and create new products. As private labels keep growing, regular brands must work harder to stay popular.

Protein Innovation

Animal and Plant-Based

Grocery stores are selling more animal and plant-based protein foods. The U.S. plant-based food market grew from $3.9 billion in 2017 to $8.1 billion in 2024. This happened because new foods taste and feel more like animal-based foods. Many people now buy both animal and plant-based protein. Almost 75% of U.S. shoppers ages 18 to 59 are willing to try plant-based meat and dairy. In Germany, about 30% of people are flexitarian and eat both kinds of protein. The U.S. plant-based protein market grows over 7% every year. In Europe, people ate 49% more plant-based foods in two years.

Plant-based meat substitutes are growing the fastest in protein foods.

Pea protein is the most quickly growing plant-based protein.

More than 80% of people want more protein in their food and drinks.

Plant-based milk is now about 14% of all milk sold in the U.S.

Stores use these facts to decide what to sell and how to advertise. They work on making foods taste better and cost less to get more shoppers. People keep changing what kinds of protein they eat as they try new foods.

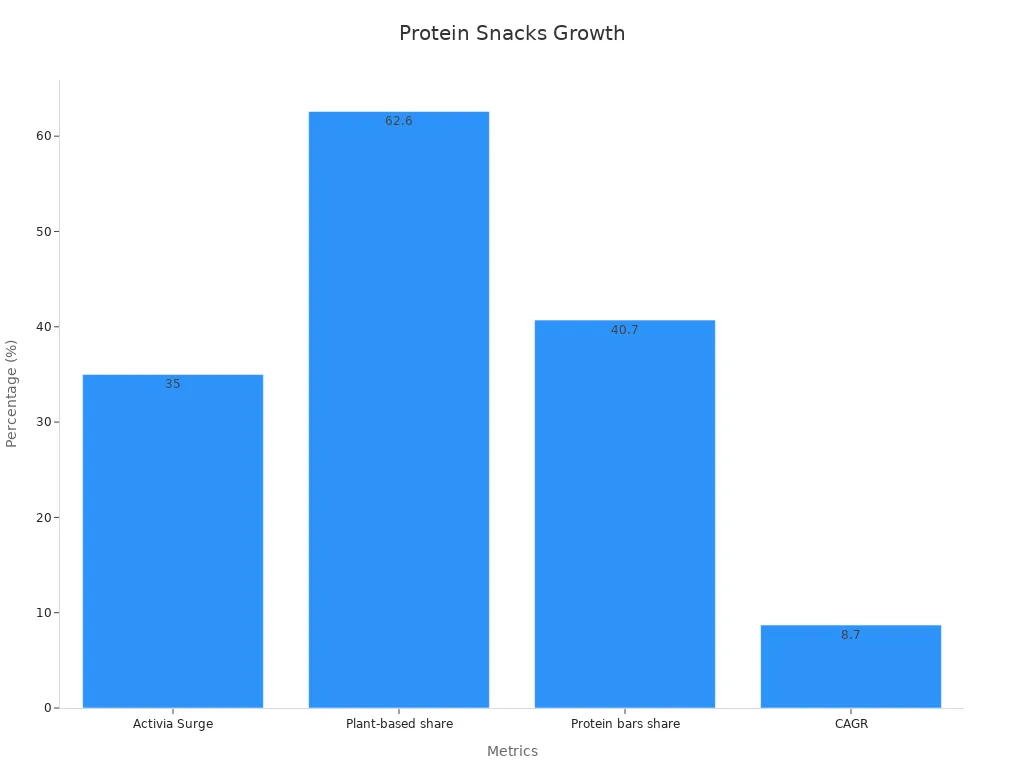

Protein Snacks

Protein snacks are making big changes in snacks. These snacks are now worth $24 billion out of the $126 billion U.S. snack market. Protein snacks are growing three times faster than other snacks. Younger people, like Gen Z and millennials, now make up 34% of protein snack buyers. This number was 29% in 2019. Many people want snacks with more protein, but only 19% of snacks have enough protein.

Brands are making new protein snacks with plant-based pulses, prebiotic bars, and special dairy snacks. Flexitarian diets, which mix plant and animal proteins, are popular with 42% of people around the world.

The table below shows important facts about protein snacks:

Metric / Insight | Data / Description |

|---|---|

Protein snacks market value | $24 billion |

Protein snacks growth vs overall snacking | 3x faster |

Plant-based protein snacks market share projection | 62.6% in 2025 |

Protein bars market share projection | 40.7% in 2025 |

Global protein snacks market size | $4.8B (2025) to $8.6B (2032) |

CAGR of protein snacks market | 8.7% |

Consumer trend: Flexitarianism | 42% of global consumers |

Stores are giving more space to protein snacks and using fun ads. People want snacks that are easy to eat and healthy, so companies keep making new kinds.

Global Flavors

International Cuisine

Grocery stores now sell more foods from other countries. Shoppers want to taste new foods from all over the world. Stores add products from Asia, Europe, South America, and the Middle East. More people move to new places and bring their food traditions with them. This makes global cuisine more popular. Supermarkets and hypermarkets lead this trend because they have many choices. The table below shows how different areas enjoy international foods:

Region | Key Consumption Statistics and Trends |

|---|---|

Global | Hypermarkets and supermarkets have many international foods. Migration and multicultural shoppers help this trend grow. |

Asia Pacific | This region has a big market share in 2024. Ethnic foods are now part of regular meals in the U.S., Italy, Germany, China, Japan, India, Australia, and UAE. |

North America | People want more ethnic foods, especially Asian and Mexican. Immigration and interest in new flavors help this grow. New technology keeps foods fresh longer. |

Europe | Growth is slow but steady. Local foods like Italian, Spanish, French, and Greek are very popular. Other ethnic foods grow slowly. Mexican food is growing slowly. |

South America | Growth is steady. Brazil and Argentina make a lot of food. Better freezing technology helps keep foods available. |

Middle East & Africa | This market is just starting to grow. More people want Asian and Hispanic foods. This is because more Asian people move here and more people have higher incomes. |

People want real international flavors when they shop. Stores use new technology to keep foods safe and fresh. This lets shoppers try dishes from many cultures at home.

Bold and Briny

Shoppers now want bold and briny flavors in their food. They want more than just spicy tastes. They look for flavors that are strong and exciting. Many people pick foods with lots of spices or sour, fermented tastes. These trends show this change:

Kroger says people care about how heat makes food taste better, not just how spicy it is.

Shoppers try new spices like Calabrian chiles, guajillo peppers, and hatch chiles.

Foods like olives, pickles, sauerkraut, and kimchi are more popular now.

Experts and big stores see more people wanting bold and briny flavors.

These trends show shoppers want new taste adventures. Stores add more foods with strong spices and briny flavors. This makes grocery shopping more fun for everyone.

Sustainability in Grocery Retail Industry

Regenerative Practices

Regenerative practices help grocery stores care for the planet. These methods make soil healthier and help more plants and animals live. They also pull carbon from the air. This helps slow down climate change and makes farms better over time. Many stores work with farmers who use these good methods. Farmers often learn from each other and try new ways to help the earth. Stores want to keep shoppers who care about nature. There are some problems, like different ways to check results and tough rules for reports. Certified Crop Advisors want more lessons about these ideas. Some programs give money and ads to help farmers start early. When stores and their suppliers work together, these plans get stronger.

Agmatix’s RegenIQ platform lets companies see how well regenerative agriculture works. It shows clear facts about how these methods help the earth and save money. The CEO says more people need to use these ideas to reach climate goals. Tools like this help farmers and stores feel sure about trying new things.

The world market for regenerative agriculture could be $3.24 billion by 2030. North America uses these ideas most because of early help and good rules. Asia-Pacific is growing fast because of new tech and government support. Most work is about better soil, more carbon capture, and more life on farms.

Controlled-Environment Agriculture

Controlled-environment agriculture, or CEA, uses tech to grow food inside. Growers can change light, heat, and water to help plants grow. CEA grows more food in small spaces and does not need good weather. Vertical farms, a kind of CEA, use less water and almost no pesticides. They can grow lettuce with 90 grams for each kilowatt-hour of energy. Big vertical farms use about 10-11 kWh for each kilogram of lettuce. These farms make less greenhouse gas than regular farms, especially when food comes from far away. Water and plant food are used almost all the way, so there is little waste.

Metric | Value | Notes |

|---|---|---|

Energy use efficiency for lettuce | 90 g/kWh | Vertical farms, red:blue light ratio 3 |

Energy consumption per kg of lettuce | 10-11 kWh | Large commercial vertical farms |

Greenhouse gas emissions | Lower than conventional | Life cycle assessment, vertical farm in Sweden |

Water and nutrient use efficiency | Close to 100% | Vertical farming systems |

Pesticide use | Mostly absent | Vertical farming systems |

CEA helps the planet by using less and wasting less. It lets stores sell fresh, local food all year. As tech gets better, CEA will help make food systems greener.

Home Cooking Trends

DIY Food Culture

A lot of people like cooking and eating at home now. They want to be healthier, save money, and pick their own ingredients. Surveys say 81% of people make most of their meals at home. About 64% of Americans cook at home to spend less. Social media, like TikTok and YouTube, gives many people ideas for new recipes. More than half of people try new ways to cook because of these sites. Younger people, like millennials and Generation Z, really like healthy and plant-based foods. They also like to try new tastes and cooking styles.

People use new kitchen tools to make cooking simple. Air fryers are used by 45% of people, and slow cookers by 43%. Many shoppers buy frozen fruits and veggies that are already cut to save time. Cooking outside and planning meals is getting more popular. Over half of adults buy things for these activities. Meal kit services and online grocery shopping help people cook at home with less work. These changes show that more people want to make their own food.

Reducing Ultra-Processed Foods

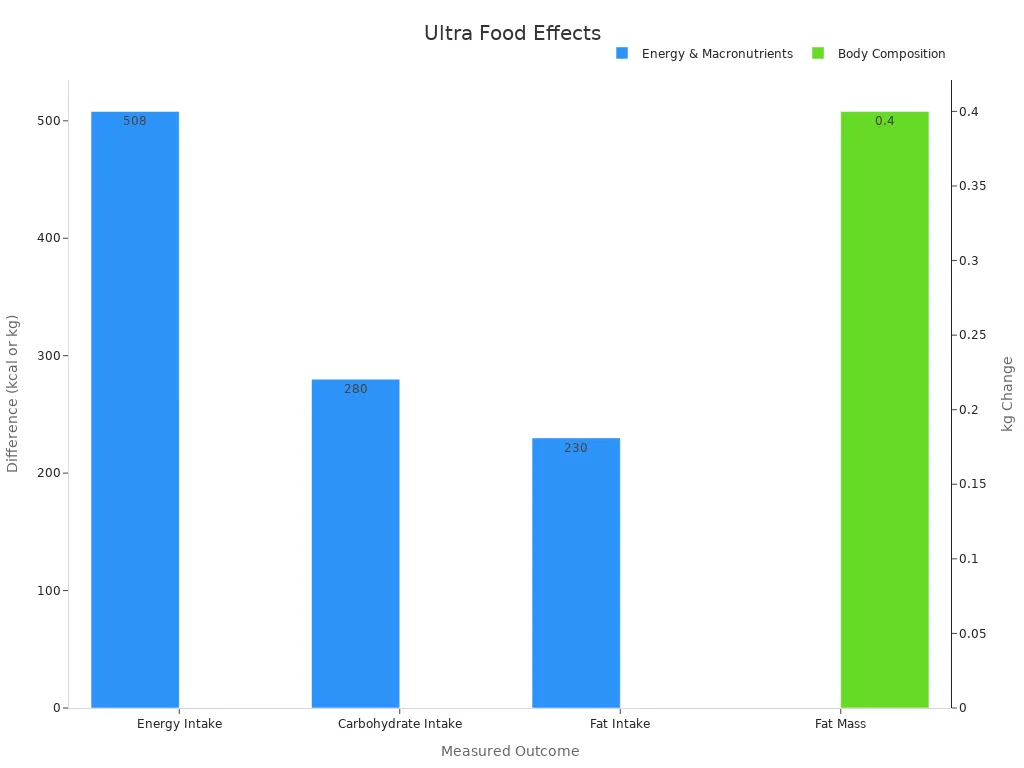

People care more about what they eat now. Many pick home-cooked meals to stay away from ultra-processed foods. These foods can be bad for health. Studies say eating more ultra-processed foods makes people eat more, gain weight, and get more body fat. People who eat less processed foods are healthier. They may lose weight and have better cholesterol.

Measured Outcome | Ultra-Processed Diet | Minimally Processed Diet | Statistical Significance |

|---|---|---|---|

Energy Intake | — | p = 0.0001 | |

Carbohydrate Intake | +280 kcal/day | — | p = 0.0001 |

Fat Intake | +230 kcal/day | — | p = 0.0004 |

Weight Change | +0.9 kg | -0.9 kg | p = 0.009, 0.007 |

Fat Mass | +0.4 kg | — | p = 0.0015 |

Words like “natural” or “organic” on packages can change how people think about food. Labels and warnings help shoppers pick better foods. Because of this, more families cook at home to be healthier and feel better.

Food Trend Predictions and Technology

Digital Transformation

Technology is changing grocery stores. Stores use digital tools to guess food trends and work better. Many stores use AI, IoT, and automation now. These tools help stores know what shoppers want and when. McKinsey says 52% of store jobs can be done by machines today. This can make profits go up by 3 to 5 percent. Stores watch numbers like how fast they fill orders and how happy customers are. Walmart uses AI and data to track stock and cut waste. Automation and digital dashboards help stores work faster and make fewer mistakes. Smart picking tools and real-time inventory help stores fill orders fast and keep shelves full. These new tools help stores guess food trends and serve shoppers better.

Digital transformation gives stores a big edge. They can see new trends, change prices, and keep shoppers happy.

panpantech Electronic Shelf Labels

panpantech’s Electronic Shelf Labels help stores keep up with food trends. These labels use E-Ink and NFC to change prices fast and right. Stores save up to 80% on work costs by changing prices with machines. Pricing mistakes drop by about 30%, so shoppers trust the store more. Maurer’s Market now changes prices in under ten minutes instead of four days. Stores like Carrefour and Tesco spend 80% less time fixing labels and make 50% fewer price mistakes. ESLs let stores change prices more often, so they can react to food trends and sell more. Changing prices quickly also cuts waste, sometimes from 20-30% to almost none. Linking ESLs with POS and inventory keeps prices right everywhere. Shoppers see clear prices and deals, which makes them happier.

Benefit | Impact |

|---|---|

Labor cost reduction | Up to 80% |

Pricing error reduction | Around 30% |

Price update speed | From days to minutes |

Waste reduction | From 20-30% to nearly zero |

Customer satisfaction | Higher due to price clarity and promotions |

Esl Retail Solutions

ESL Retail Solutions from panpantech help stores work better and get ready for new food trends. These tools mean stores do not need paper labels, so they save time and money. Workers can help shoppers instead of changing prices by hand. Prices update in real time in all stores, so shoppers always see the right price. Changing prices quickly helps stores sell more and move stock. Cloud analytics and CRM give stores deep ideas about what shoppers want. QR codes and NFC on ESLs make shopping more fun and interactive. AI and Gen AI in ESLs help stores know when to fix things before they break. These tools help stores stay ahead of food trends and keep shoppers coming back.

Grocery stores in 2025 use new tech, private-label items, and green ideas to do well. Many stores use AI to help people shop and keep track of products. This can help stores sell more and make more money. Supermarkets and other stores want to give fast service. They also want shopping online and in stores to be easy. Panpantech’s Electronic Shelf Labels let stores change prices fast and make shoppers happy. Stores that follow these trends and use smart tools will be the leaders.

FAQ

What are the main grocery retail trends for 2025?

Retailers are using more technology and care about the planet. Private label products are getting more popular. Stores offer foods from many countries. Electronic shelf labels help stores change prices fast and waste less. Shoppers want healthier choices and foods from around the world.

How do electronic shelf labels benefit grocery stores?

Electronic shelf labels let stores change prices right away. They help stores spend less money on work and make fewer price mistakes. Stores also use less paper, which is better for the environment.

Why is sustainability important in grocery retail?

Sustainability helps stores take care of nature and meet what shoppers want. Many stores use less energy and work with local farms. These steps help cut down on waste and lower pollution.

How does technology predict food trends?

Stores use AI and data to see what people buy. This helps them find new trends before others do. Technology also helps stores keep track of products and throw away less food.

Who is panpantech, and what do they offer?

Panpantech makes advanced electronic shelf labels and other store tools. Their products help stores change prices, track items, and make shopping better. Panpantech works in over 100 countries with smart, energy-saving technology.